Calculate Your Gratuity Instantly

Know exactly how much gratuity you are entitled to in just a few seconds.

Gratuity Calculator

Total Gratuity Payable To You

₹0.00

A Gratuity Calculator is an online financial tool designed to help employees estimate the gratuity amount they may receive from their employer after completing a specified period of service. Gratuity is a statutory benefit in India, paid as a lump sum to employees as a reward for their long-term commitment and service to an organisation. Since gratuity calculations involve specific formulas and legal rules, using a calculator simplifies the process and ensures greater accuracy.

The primary purpose of using a gratuity calculator is to eliminate the need for manual calculations, which can often be confusing and prone to errors. By entering basic details such as last drawn salary and total years of service, employees can instantly view an estimated gratuity amount. This allows individuals to make informed decisions related to job changes, retirement planning, and long-term financial goals without relying solely on HR departments or complex spreadsheets.

For salaried employees in India, gratuity plays a crucial role in overall financial security. It often represents a significant portion of post-employment benefits, especially for those who have spent many years with the same employer. Understanding how gratuity works and how much one may receive helps employees plan savings, manage expenses after retirement or resignation, and avoid unexpected financial gaps. A reliable gratuity calculator helps bring transparency and clarity to this important employment benefit.

In the gratuity calculator India context, calculations are governed by the Payment of Gratuity Act, 1972, which outlines eligibility criteria, calculation methods, and maximum payout limits. While individual company policies may vary slightly, most gratuity calculations follow the same statutory framework. This makes an online gratuity calculator particularly useful, as it applies standard rules consistently and provides quick, easy-to-understand results for employees across different industries in India.

What Is Gratuity?

Gratuity is a lump sum monetary benefit paid by an employer to an employee as a mark of appreciation for long and continuous service. It is not deducted from an employee’s salary; instead, it is paid entirely by the employer when an employee leaves the organisation after meeting eligibility criteria. Gratuity acts as a financial reward for loyalty and long-term contribution to a company.

Legal Background: Payment of Gratuity Act, 1972

In India, gratuity is governed by the Payment of Gratuity Act, 1972, which provides a statutory framework for gratuity payments. The Act applies to factories, mines, oilfields, plantations, ports, railways, shops, and establishments with 10 or more employees. Once an organisation is covered under the Act, it remains applicable even if the number of employees falls below ten in the future.

The Act defines:

- Eligibility conditions for gratuity

- The method used to calculate gratuity

- The maximum gratuity payable

- The time frame within which gratuity must be paid

This legal framework ensures that employees receive fair compensation for long-term service, and it forms the foundation of every accurate gratuity calculation in India.

Why Gratuity Is Paid to Employees

Gratuity is paid to employees as a financial recognition of dedication and continuity of service. It encourages employee retention by rewarding long-term commitment and provides financial support at important life transitions such as retirement, resignation, or unforeseen circumstances like disability or death.

For many employees, gratuity becomes an important part of retirement planning or financial security after leaving a job. This is why using a gratuity calculator online is helpful—it allows employees to estimate this benefit in advance and plan their finances more effectively.

Difference Between Gratuity and Other Retirement Benefits

Gratuity is often confused with other retirement or post-employment benefits, but it is distinct in several ways:

- Provident Fund (PF): Funded by both employer and employee contributions, whereas gratuity is fully paid by the employer.

- Pension: Provides regular monthly income after retirement, while gratuity is a one-time lump sum payment.

- Leave Encashment: Payment for unused leave days, separate from gratuity and calculated differently.

- Superannuation Fund: A retirement benefit funded by employer contributions, applicable only in certain organisations.

Unlike these benefits, gratuity is directly linked to length of service and is payable only after meeting specific eligibility criteria. Understanding these differences helps employees appreciate the unique role gratuity plays in long-term financial planning.

Who Is Eligible for Gratuity in India?

Gratuity eligibility in India is defined under the Payment of Gratuity Act, 1972, which sets specific conditions that employees must meet to receive gratuity. Understanding these eligibility rules is essential before using a gratuity calculator, as gratuity is payable only when statutory criteria are satisfied.

Minimum Service Requirement (5 Years Rule)

In most cases, an employee becomes eligible for gratuity after completing a minimum of five years of continuous service with the same employer. Continuous service includes uninterrupted employment and may also account for certain breaks such as leave, sickness, accident, or authorised absence, as defined under the Act.

It is important to note that service of four years and 240 days is often considered as completing five years in many judicial interpretations, particularly for employees working six days a week. However, this may vary based on court rulings and company policies.

A gratuity calculator India generally assumes completion of five full years when calculating gratuity.

Exceptions: Death or Disability

The five-year minimum service requirement does not apply in cases where gratuity becomes payable due to:

- The death of the employee

- Permanent disablement caused by accident or illness

In such situations, gratuity is payable regardless of the length of service completed. In the event of death, gratuity is paid to the employee’s nominee or legal heir. This exception ensures financial support for the employee’s family during difficult circumstances.

Types of Employees Covered

Gratuity eligibility extends to a wide range of employees, including:

- Permanent employees

- Temporary and contractual employees (if conditions under the Act are met)

- Full-time employees

- Fixed-term employees

The key factor is not job designation but whether the employee has rendered continuous service in an establishment covered under the Act.

Applicability Across Private, Public, and Government Sectors

Gratuity provisions apply across multiple employment sectors in India:

- Private Sector: Most private companies with 10 or more employees are covered under the Payment of Gratuity Act.

- Public Sector Undertakings (PSUs): Gratuity rules apply as per statutory and organisational regulations.

- Government Sector: Government employees are governed by separate gratuity rules but are also entitled to gratuity benefits.

While the calculation method may differ slightly between sectors, the concept of gratuity remains consistent. A gratuity calculator online helps employees across all sectors estimate their entitlement using standard calculation rules.

gratuity calculation formula

The gratuity payable to an employee in India is calculated using a standard statutory formula defined under the Payment of Gratuity Act, 1972. This formula is used by every accurate Gratuity Calculator to ensure consistency and compliance with Indian labour laws.

Standard Gratuity Calculation Formula

The standard formula used in India is:

Gratuity = (Last Drawn Salary × 15 × Years of Service) ÷ 26

This formula calculates gratuity based on the employee’s final salary and total completed years of service.

Explanation of Each Component

Understanding the individual components of the gratuity calculation helps employees interpret the results produced by a Gratuity Calculator and verify their estimated benefits.

Basic Salary

The basic salary is the fixed portion of an employee’s monthly pay. It excludes bonuses, commissions, overtime, and other variable components. For gratuity purposes, only the basic salary is considered, along with dearness allowance where applicable.

Dearness Allowance (DA)

Dearness Allowance (DA) is a cost-of-living adjustment provided to employees to counter inflation. When DA is part of the salary structure, gratuity is calculated on the combined amount of basic salary and DA. If DA is not applicable, gratuity is calculated using basic salary alone.

Years of Service

Years of service represent the total number of completed years an employee has worked continuously with the same employer. Continuous service includes authorised leave, sickness, maternity leave, and other approved absences as defined under the Act.

The number of completed service years directly impacts the gratuity amount—longer service results in higher gratuity entitlement.

The 15/26 Factor Explained

The 15/26 factor is used to standardise gratuity calculations across industries:

- 15 represents 15 days’ wages payable for each completed year of service

- 26 represents the number of working days in a month

This factor ensures fair and uniform gratuity calculation under Indian labour law.

Rounding Rules for Years of Service

Rounding of service years plays an important role in gratuity calculation:

- Service exceeding six months in a year is rounded up to the next full year

- Service of six months or less is ignored

Examples:

- 8 years and 8 months → counted as 9 years

- 8 years and 5 months → counted as 8 years

These rounding rules are automatically applied in a properly designed Gratuity Calculator.

Applicability of the Formula in India

The gratuity calculation formula applies to:

- Employees covered under the Payment of Gratuity Act, 1972

- Private sector organisations with 10 or more employees

- Public sector undertakings

Government employees may be governed by separate service rules, but the concept of gratuity remains similar.

A Gratuity Calculator helps employees estimate their gratuity using this statutory formula, providing clarity and confidence for financial planning.

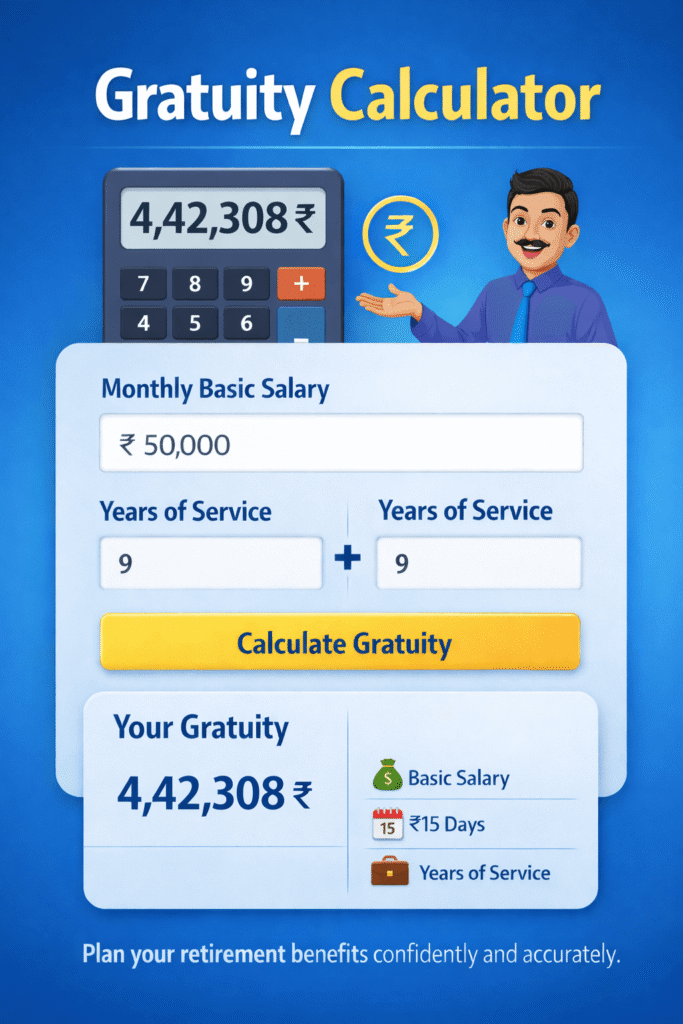

How the Gratuity Calculator Works

A Gratuity Calculator is designed to simplify the complex process of gratuity computation by automating statutory rules and calculations. It converts key employment details into an estimated gratuity amount instantly, helping employees understand their entitlement without technical knowledge of formulas or labour laws.

Inputs Required in a Gratuity Calculator

To calculate gratuity accurately, the calculator requires only a few essential inputs:

- Last drawn salary

This includes the basic salary and dearness allowance (DA), if applicable. - Years of service

The total number of completed years an employee has worked with the same employer, calculated as per statutory rounding rules.

These inputs are sufficient to estimate gratuity under the Payment of Gratuity Act, 1972.

Step-by-Step Calculation Flow

The working process of a Gratuity Calculator typically follows these steps:

- The user enters their last drawn basic salary (and DA, if applicable).

- The user selects or inputs the total years of completed service.

- The calculator applies the statutory gratuity formula:

- (Salary × 15 × Years of Service) ÷ 26

- Rounding rules for service years are applied automatically.

- The final gratuity amount is displayed instantly.

This structured flow ensures consistency, accuracy, and compliance with Indian gratuity laws.

Real-Time Calculation Benefits

One of the key advantages of using a Gratuity Calculator is real-time calculation. Any change in salary or years of service instantly updates the gratuity amount, allowing users to:

- Compare different service durations

- Evaluate the impact of salary changes

- Plan resignation or retirement more effectively

- Gain immediate clarity without delays

Real-time updates make the calculator especially useful for financial planning and decision-making.

Why a Gratuity Calculator Is More Reliable Than Manual Calculation

Manual gratuity calculation often leads to errors due to:

- Incorrect salary components being used

- Mistakes in applying the 15/26 factor

- Incorrect rounding of years of service

- Misinterpretation of eligibility rules

A well-designed Gratuity Calculator eliminates these issues by applying statutory rules automatically and consistently. Compared to manual methods, a digital calculator (including a gratuity calculator online) provides faster, more accurate, and more dependable results for employees.

Example of Gratuity Calculation

Understanding the Gratuity Calculator formula becomes much easier with a real-world example. Below, we provide step-by-step illustrations to help employees visualize how gratuity is computed in India.

Example 1: Basic Scenario

Scenario:

- Last drawn basic salary + DA: ₹25,000 per month

- Total years of service: 10 years

Calculation Using the Standard Formula:

Step 1: Multiply the last drawn salary by 15:

Step 2: Multiply by years of service:

Step 3: Divide by 26 (number of working days):

Result: The employee’s gratuity entitlement is approximately ₹1,44,231.

A Gratuity Calculator automatically performs these steps, saving time and eliminating manual errors.

Example 2: Service with Partial Year Rounding

Scenario:

- Last drawn salary: ₹30,000 per month

- Total service: 12 years and 7 months

Step 1: Apply Rounding Rules

Since 7 months > 6 months, the total years of service are rounded up to 13 years.

Step 2: Apply Gratuity Formula

Result: The employee’s gratuity entitlement is ₹2,92,500.

This demonstrates how the Gratuity Calculator correctly applies rounding rules for partial years.

Example 3: Minimum Service Exception (Disability or Death)

Scenario:

- Last drawn salary: ₹20,000 per month

- Total service: 3 years

- Reason for leaving: Permanent disability

Explanation:

Although the minimum service requirement is 5 years, the Payment of Gratuity Act allows exceptions for death or permanent disability.

Result: The employee is eligible for ₹34,615 gratuity even with less than 5 years of service.

Key Takeaways from These Examples

- The Gratuity Calculator automatically applies statutory rules, including rounding, minimum service requirements, and exceptions.

- Partial years are rounded according to the Act, ensuring fair computation.

- Exceptions such as death or disability are handled correctly, which is difficult in manual calculation.

- Employees can quickly compare different scenarios to make informed career and financial decisions.

By using a Gratuity Calculator, employees can confidently plan for retirement, resignation, or career changes while understanding exactly how much gratuity they are entitled to.

Maximum Gratuity Limit in India

While a Gratuity Calculator helps employees estimate their entitlement based on salary and years of service, it’s essential to understand that gratuity payments in India are capped by statutory limits.

This ensures uniformity and compliance with Indian labour laws while giving employers and employees a clear framework.

Current Statutory Gratuity Cap

As of 2023-24, the Payment of Gratuity Act, 1972 sets the maximum gratuity limit at ₹20 lakh for employees covered under the Act.

- This means even if the formula-based calculation exceeds ₹20 lakh, the statutory gratuity payable cannot exceed this limit.

- The cap applies to all employees in establishments governed by the Act, including private, public, and PSU employees.

A Gratuity Calculator automatically considers this cap when displaying the estimated gratuity amount, preventing overestimation.

Applicability of the ₹20 Lakh Limit

The ₹20 lakh cap applies specifically to employees under the Payment of Gratuity Act:

- Private sector employees in organisations with 10 or more employees

- Public sector employees (unless specific PSU rules apply)

- Certain contractual employees, if employed continuously under the same establishment

Employees in government services may have separate rules and higher caps depending on service rules. In such cases, a Gratuity Calculator may provide estimates based on the statutory formula but should be cross-checked with government guidelines.

Employer Discretion Beyond Statutory Limits

While ₹20 lakh is the legal maximum, employers may voluntarily offer higher gratuity as part of:

- Company retirement benefits

- Special service recognition

- Individual employment contracts

This discretionary gratuity is often paid in addition to statutory entitlement. Employees should confirm their organisation’s gratuity policy to understand if benefits exceed the statutory limit.

Taxation Rules on Gratuity in India

Gratuity is a retirement benefit provided to employees, and like most forms of income, it is subject to taxation under the Income Tax Act, 1961. However, the tax treatment varies depending on the type of employment, statutory limits, and exemptions.

Tax Treatment for Government Employees

For government employees, gratuity is fully exempt from tax regardless of the amount. This includes employees in central government, state government, and defence services.

- Even if the gratuity exceeds ₹20 lakh, the entire amount remains tax-free under the Income Tax Act.

- This exemption applies whether the gratuity is received on retirement, superannuation, or resignation.

This makes gratuity a particularly valuable benefit for government employees, and a Gratuity Calculator can show the full, untaxed amount for planning purposes.

Tax Treatment for Private Sector Employees

For private sector employees covered under the Payment of Gratuity Act, 1972, tax exemptions are limited by statutory rules:

- Gratuity received up to a certain exemption limit is tax-free.

- Any amount exceeding the limit is considered taxable income and must be included in the employee’s annual taxable salary.

The current exemption limit for private sector employees is ₹20 lakh, in line with the maximum gratuity allowed under the law. Any gratuity received beyond this limit is subject to income tax at applicable rates.

Exemption Limits Under the Income Tax Act

The Income Tax Act provides clear guidance on gratuity exemptions:

- Government employees: Fully exempt, no maximum limit

- Private sector employees (covered by Gratuity Act): Exempt up to ₹20 lakh

- Non-covered employees (companies with fewer than 10 employees or contractual staff): Exemption calculated using a formula based on last drawn salary, completed years of service, and 15-day wages per year, but within statutory limits

A Gratuity Calculator for private sector employees automatically considers these exemption limits to display the tax-free portion and the taxable portion, helping employees plan their finances better.

When Gratuity Becomes Taxable

Gratuity becomes taxable in the following situations:

- If the received amount exceeds the statutory exemption limits (e.g., above ₹20 lakh for private sector employees).

- If the employee belongs to a company not covered by the Payment of Gratuity Act, and the gratuity exceeds the calculated tax-free amount.

- If gratuity is received by employees before completing the minimum years of service, except in cases of death or permanent disability (these may still qualify for exemptions).

In these cases, the taxable portion of gratuity is added to the employee’s total income and taxed according to the applicable income tax slab.

Benefits of Using a Gratuity Calculator

A Gratuity Calculator provides employees with several advantages, making it an essential tool for financial planning:

- Accuracy and Speed: Manual calculation of gratuity can be prone to errors, especially with rounding rules, DA inclusion, and statutory caps. A calculator provides instant and precise results.

- Ease of Financial Planning: Knowing your estimated gratuity helps plan future expenses, retirement, or savings. Employees can make informed decisions regarding career moves or investments.

- Mobile and Desktop Accessibility: Most calculators are accessible online, allowing users to check gratuity anytime, anywhere, whether on a mobile device or desktop.

- Useful for Resignation and Retirement Planning: By entering different scenarios, employees can quickly see how their gratuity changes if they resign, retire early, or complete full service, providing a clear picture of their entitlement.

Gratuity Calculator for Different Employment Scenarios

A Gratuity Calculator can accommodate multiple employment situations, ensuring employees can estimate their benefits accurately:

- Resignation after 5+ Years: Employees who resign after completing the minimum service of 5 years can calculate their exact gratuity entitlement. The calculator automatically applies the statutory formula and rounding rules.

- Retirement Cases: For employees retiring after long service, the calculator helps project the final gratuity payout, including DA and other salary components.

- Death or Disability Scenarios: In cases of death or permanent disability, the minimum service requirement is waived, and the calculator can provide an accurate estimate even if the employee has less than 5 years of service.

- Contract and Fixed-Term Employment Considerations: Some employees may be on short-term or fixed contracts. The calculator can estimate gratuity based on the actual completed service, ensuring accurate computation according to legal provisions.

Common Mistakes in Gratuity Calculation

Even with a Gratuity Calculator, employees sometimes make errors that can lead to inaccurate estimates. Awareness of these common mistakes helps ensure reliable results:

- Using Gross Salary Instead of Basic + DA

Many users mistakenly enter gross salary, which includes allowances, bonuses, or incentives. The correct inputs for a gratuity calculation are basic salary and dearness allowance (DA), as specified by the Payment of Gratuity Act. - Incorrect Service Year Calculation

Errors often occur when calculating completed years of service. Remember that partial years are rounded according to statutory rules: more than 6 months is rounded up, less than 6 months is ignored. - Misunderstanding Eligibility

Employees who have not completed the minimum service period of 5 years may assume they are ineligible. Exceptions such as death or permanent disability still qualify, and a good Gratuity Calculator accounts for these scenarios. - Ignoring Tax Implications

Some users overlook that gratuity may be taxable if it exceeds statutory limits (₹20 lakh for private sector employees). While a calculator estimates the total gratuity, employees should be aware of the taxable portion to plan finances accurately.

By avoiding these mistakes, employees can rely on a Gratuity Calculator for accurate financial planning.

Limitations of a Gratuity Calculator

While a Gratuity Calculator is highly useful, it is important to understand its limitations:

- Estimated Values vs Actual Payout

The calculator provides estimated gratuity amounts based on statutory formulas. The actual payout may differ slightly due to company practices, rounding methods, or accounting adjustments. - Company-Specific Policy Differences

Some employers provide discretionary gratuity beyond statutory limits, or have unique rules for service calculation. A generic calculator may not account for such policies. - Legal Amendments and Rule Changes

The Payment of Gratuity Act or Income Tax rules may be amended from time to time, affecting the calculation. Employees should ensure their calculator is updated with the latest rules or cross-check with HR or legal resources.

Understanding these limitations ensures that users treat the Gratuity Calculator as a reliable planning tool while consulting official sources for final confirmation.

FAQS

Conclusion

Gratuity is a valuable retirement benefit for employees, providing financial security after years of dedicated service. Understanding how gratuity is calculated, including components such as basic salary, dearness allowance, and years of service, helps employees make informed decisions about their financial future.

Using a Gratuity Calculator allows employees to quickly estimate their entitlement, ensuring they are aware of the potential benefits and any statutory limits, such as the ₹20 lakh cap for private sector employees. It also aids in planning for retirement, resignation, or unexpected scenarios like disability or death, where gratuity calculations may vary.

By leveraging a Gratuity Calculator India tool, employees can save time, avoid calculation errors, and gain a clear understanding of their retirement benefits. Whether you are planning long-term finances or considering career moves, this tool serves as a reliable and accessible resource to support financial planning with confidence.