Calculate Your Complete CTC in Seconds

Get a detailed breakdown of your Cost to Company and in-hand salary with accurate tax calculations.

CTC Calculator India

Your Annual Salary Breakdown

₹ 0

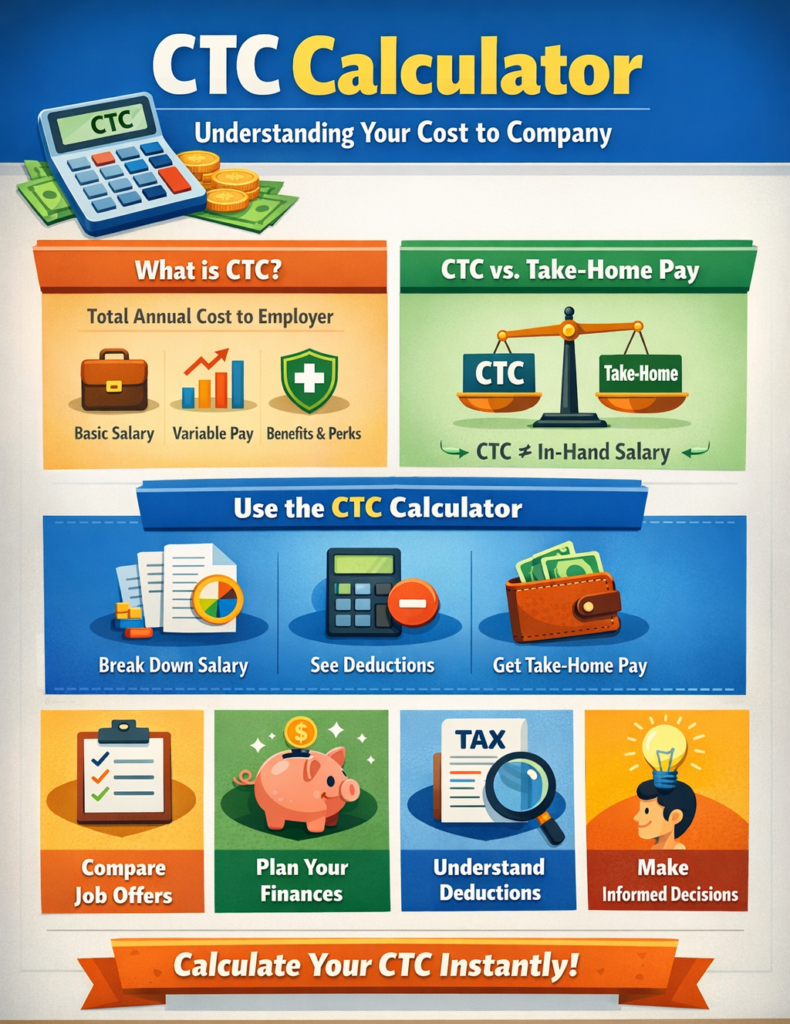

CTC, or Cost to Company, refers to the total annual expense an employer bears for an employee, not just the amount credited to the employee’s bank account each month. It includes fixed salary components, variable pay, and employer-paid benefits such as provident fund contributions, gratuity, insurance, and bonuses. A common misconception is that CTC equals take-home salary, whereas in reality, the in-hand amount is usually much lower after deductions and statutory contributions.

Using a CTC Calculator makes it easy to break down your salary and understand each component clearly. A calculator instantly shows your take-home pay, deductions, and employer contributions, removing guesswork and helping you see the full picture.

Understanding CTC is important because it helps employees evaluate job offers accurately, compare salaries across companies, plan finances realistically, and stay informed about tax and statutory deductions. Having clarity with a CTC Calculator ensures better decision-making and avoids confusion when negotiating or reviewing compensation packages.

What Is Included in CTC?

CTC is not a single payment but a combination of multiple fixed and variable components that together represent the total cost an employer spends on an employee in a year. Some of these components are paid monthly as part of the regular salary, while others are paid annually, periodically, or only when specific conditions are met. Understanding how these components are structured helps employees clearly see where their compensation comes from and why the take-home salary differs from the total CTC.

Fixed Salary Components

Fixed salary components are guaranteed payments that an employee receives regularly, usually on a monthly basis. These amounts are not dependent on performance and form the core structure of the salary package.

- Basic Salary – The primary component of salary and the basis for calculating several other benefits and deductions such as PF and gratuity.

- Dearness Allowance (DA) – Paid mainly in government or public-sector roles to offset inflation (if applicable).

- House Rent Allowance (HRA) – Provided to support rental housing expenses and may offer tax benefits under certain conditions.

- Conveyance Allowance – Covers daily commuting or transportation costs.

- Medical Allowance – Intended to meet routine medical expenses, subject to tax rules.

- Special Allowance – A flexible component used to balance the salary structure and increase CTC.

Variable Pay Components

Variable pay refers to earnings that are not fixed and depend on performance, productivity, or company results. These components may be paid monthly, quarterly, or annually and are often linked to individual or organizational goals.

- Performance Bonus – Paid based on individual or company performance metrics.

- Incentives – Rewards for achieving specific targets or milestones.

- Sales Commission – Earnings linked directly to sales performance, common in sales roles.

- Productivity or KPI-Based Bonuses – Paid for meeting predefined efficiency or output benchmarks.

Employer Contributions

Employer contributions are costs borne by the employer on behalf of the employee and are included in CTC even though they are not received as direct cash in hand. These contributions provide long-term financial security and statutory compliance.

- Employer Provident Fund (PF) – The employer’s contribution to the employee’s retirement savings.

- Employer ESIC Contribution – Applicable for eligible employees under the ESIC scheme.

- Gratuity Contribution – Set aside by the employer as an end-of-service benefit.

- Superannuation Fund – A retirement benefit offered by some organizations as an additional savings plan.

Together, these components form the complete CTC structure, helping employees understand both immediate earnings and long-term benefits.

What Is Not Included in Take-Home Salary?

While CTC represents the total cost incurred by the employer, it is important to understand that CTC is not the same as take-home (in-hand) salary. The take-home salary is the amount an employee actually receives after various deductions and exclusions. Several components that are part of CTC either get deducted before payment or are offered as long-term or conditional benefits, which is why the in-hand salary is always lower than the quoted CTC.

Statutory Deductions

Statutory deductions are mandatory deductions required by law and are subtracted directly from the employee’s gross salary before it is paid. These deductions play a key role in social security and tax compliance but reduce the monthly take-home amount.

- Employee Provident Fund (PF) – A fixed percentage of basic salary contributed toward retirement savings.

- Professional Tax – A state-level tax deducted monthly or annually, depending on location.

- Income Tax (TDS) – Tax deducted at source based on the employee’s taxable income and applicable tax slab.

- ESIC (where applicable) – A mandatory health and social security contribution for eligible employees.

Conditional or Future Benefits

Some components are included in CTC but are not paid as part of the monthly salary. These benefits are either payable in the future or only under specific conditions.

- Gratuity – Payable only after completing the minimum eligibility period, typically five years.

- Retiral Benefits – Long-term benefits received upon retirement or separation.

- Stock Options (ESOPs) – Provided as ownership incentives and become valuable only when vested or exercised.

- Insurance Premiums – Health or life insurance premiums paid by the employer on behalf of the employee.

Understanding what is excluded from take-home salary helps employees realistically assess their earnings and plan finances more effectively.

CTC vs Gross Salary vs Net Salary

Many employees often confuse CTC, gross salary, and net salary, assuming they all represent the same earnings. In reality, these three terms describe different stages of salary calculation. Understanding how they relate to each other helps employees accurately evaluate job offers, understand payslips, and plan monthly finances without surprises.

CTC (Cost to Company)

CTC is the total annual expense incurred by the employer for an employee. It includes fixed salary, variable pay, bonuses, and employer-paid benefits such as provident fund contributions, gratuity, insurance, and other statutory or non-cash benefits. CTC represents the overall value of the compensation package, not the amount an employee receives in hand.

Gross Salary

Gross salary is the salary earned by the employee before any deductions are applied but after excluding employer-only benefits like gratuity contribution or employer PF. It typically includes basic salary, allowances, and applicable bonuses that are paid directly to the employee.

Net Salary (Take-Home Pay)

Net salary, also known as take-home pay, is the actual amount credited to the employee’s bank account after deducting statutory contributions and taxes such as employee PF, income tax (TDS), professional tax, and ESIC where applicable.

Simple Salary Flow:

CTC → Gross Salary → Net Salary

This flow clearly shows how the total employer cost is gradually reduced through exclusions and deductions to arrive at the final in-hand salary.

How a CTC Calculator Works

A CTC Calculator is designed to remove confusion around salary structures by breaking down a single CTC figure into meaningful and understandable parts. Since CTC includes several fixed components, deductions, and employer contributions, manually calculating the actual take-home salary can be time-consuming and error-prone. A CTC calculator automates this process and presents a transparent salary breakdown within seconds.

The calculator begins by taking the annual CTC as the primary input. Based on standard salary structures, it then divides the CTC into monthly components, such as basic salary, allowances, and other applicable earnings. Next, it automatically applies statutory deductions, including employee provident fund, income tax (TDS), professional tax, and ESIC where relevant. Employer-only contributions are also accounted for to ensure accuracy.

Finally, the CTC calculator displays the estimated net or take-home salary, showing the exact amount an employee is likely to receive each month. This clear breakdown helps employees evaluate job offers, plan budgets, and understand pay slips, while also assisting employers in creating transparent and compliant salary structures.

CTC Calculation Formula

The CTC calculation formula is used to understand how an employee’s total compensation is structured and how much of it is actually received as take-home pay. Before looking at the formulas, it’s important to note that CTC is not calculated as a single fixed amount. Instead, it is a combination of salary paid directly to the employee and additional costs borne by the employer. These formulas help break down the overall compensation into clear, understandable parts.

Basic CTC Formula

The basic CTC formula represents the total annual cost incurred by the employer for an employee. It includes all direct salary payments as well as employer-paid contributions and benefits.

CTC = Gross Salary + Employer Contributions + Benefits

Here, gross salary covers basic pay and allowances, employer contributions include items like employer provident fund or gratuity contributions, and benefits may include insurance premiums, bonuses, or other non-cash perks.

Monthly Take-Home Formula

The monthly take-home or net salary formula shows how much an employee actually receives after mandatory deductions.

Net Salary = Gross Salary − Employee Deductions − Taxes

Employee deductions typically include employee provident fund, professional tax, and other statutory contributions, while taxes mainly refer to income tax deducted at source (TDS).

It is important to understand that CTC calculation formulas can vary depending on several factors, including the country’s labor and tax laws, company-specific salary policies, and the individual salary structure offered to an employee. This is why using a CTC calculator can provide more accurate and personalized results than manual estimation.

Step-by-Step CTC Calculation Example

Understanding CTC becomes much easier when it is explained through a real-world example. A step-by-step breakdown helps users see how the total CTC is divided into salary components, deductions, and finally the take-home salary. Below is a simple example to demonstrate how CTC is calculated and how the in-hand amount is derived.

Example Details:

- Annual CTC: ₹6,00,000

- Basic Salary: 40% of CTC

- Employer PF: 12% of Basic Salary

- Employee PF: 12% of Basic Salary

Step 1: Break CTC into Salary Components

First, calculate the basic salary.

40% of ₹6,00,000 = ₹2,40,000 per year (₹20,000 per month).

The remaining portion of CTC is distributed among allowances such as HRA and special allowance.

Step 2: Deduct Employer Contributions

Employer PF is calculated as 12% of basic salary.

12% of ₹2,40,000 = ₹28,800 per year.

Although this amount is part of CTC, it is not paid as cash to the employee and must be excluded from gross salary.

Step 3: Calculate Gross Monthly Salary

Gross salary is obtained by subtracting employer contributions from CTC.

Gross Annual Salary = ₹6,00,000 − ₹28,800 = ₹5,71,200

Gross Monthly Salary = ₹47,600

Step 4: Apply Employee Deductions

Employee PF is also 12% of basic salary.

12% of ₹2,40,000 = ₹28,800 per year (₹2,400 per month).

Other deductions such as professional tax or income tax may apply based on eligibility.

Step 5: Arrive at Take-Home Salary

Finally, subtract employee deductions from gross monthly salary.

Estimated Take-Home Salary = ₹47,600 − ₹2,400 = ₹45,200 per month (before income tax).

This step-by-step example shows how a seemingly high CTC translates into a lower take-home salary once contributions and deductions are applied.

Country-Wise Differences in CTC Structure

The concept and structure of CTC (Cost to Company) can vary significantly from country to country. While some countries follow strict statutory guidelines for contributions and benefits, others focus on a salary-plus-benefits model. Understanding these differences is essential for employees evaluating offers internationally and for employers designing compliant compensation packages.

India

In India, CTC includes mandatory contributions and benefits governed by statutory laws:

- Provident Fund (PF): Employer and employee contributions toward retirement savings.

- Gratuity: End-of-service benefit for eligible employees.

- Professional Tax: State-level tax deduction on salary.

India has a strong statutory framework, making CTC a comprehensive representation of total employee cost, including both take-home and long-term benefits.

UAE

In the UAE, the salary structure differs considerably:

- No income tax is levied on salaries.

- Gratuity replaces provident fund contributions and is paid at the end of employment based on years of service.

- Often, CTC closely matches gross salary since employer contributions are minimal or included in monthly pay.

The UAE structure is simpler but emphasizes end-of-service benefits rather than ongoing statutory contributions.

US

The US does not officially use the term CTC. Instead, employers follow a salary + benefits model:

- Base salary is combined with additional benefits like health insurance, retirement plans (401k), and bonuses.

- Employer contributions to insurance and taxes are part of the total compensation cost but are not always reflected in monthly pay.

Understanding these country-specific structures helps employees compare offers accurately and helps multinational employers create fair, transparent compensation packages.

Why Use an Online CTC Calculator?

An online CTC (Cost to Company) calculator is a powerful tool for both employees and employers. It simplifies the often confusing process of understanding salary structures, deductions, and benefits. Here are the key benefits of using an online CTC calculator:

Instant Salary Breakup

Online CTC calculators provide a detailed breakdown of your salary components in seconds. You can see your basic pay, HRA, allowances, bonuses, and other benefits without having to manually compute each component. This instant visibility helps employees understand the actual value of their compensation.

Accurate Deductions

Calculating deductions such as taxes, provident fund, professional tax, and insurance contributions can be tricky. An online CTC calculator ensures all deductions are computed accurately according to current statutory rules, reducing the chances of errors.

Helps in Job Offer Comparison

When evaluating multiple job offers, understanding the exact CTC and in-hand salary becomes critical. A CTC calculator allows you to compare salary packages side-by-side, helping you make informed decisions and choose the offer that maximizes your take-home pay.

Useful for HR and Payroll Teams

HR and payroll professionals can save time and streamline processes using a CTC calculator. It automates calculations for multiple employees, ensures compliance with statutory rules, and reduces administrative workload, enabling HR teams to focus on strategic tasks.

Eliminates Manual Calculation Errors

Manual salary calculations are prone to errors, which can lead to incorrect payouts or miscommunication. Online CTC calculators automate all computations, ensuring accuracy and reliability in both salary estimates and official payroll processing.

Key Takeaway: Using an online CTC calculator is not just convenient—it ensures accuracy, transparency, and efficiency in salary calculations for both employees and employers.

Common Mistakes While Calculating CTC

Calculating CTC (Cost to Company) can be confusing, and many employees make mistakes that lead to misunderstandings about their actual take-home pay. Understanding common pitfalls helps you avoid surprises and plan your finances better.

Assuming CTC Equals Take-Home Salary

One of the most frequent mistakes is believing that the CTC amount listed in a job offer is the same as your take-home salary. In reality, CTC includes not just your basic pay but also allowances, bonuses, employer contributions to provident fund (PF), gratuity, insurance, and other benefits. Your actual in-hand salary will always be less than the total CTC after deductions.

Ignoring Employer PF and Gratuity Contributions

Employees often overlook the employer’s contributions to PF and gratuity when calculating their benefits. While these are part of your CTC, they are not paid directly in-hand every month, but rather accumulate over time. Not accounting for them can understate your total compensation.

Overlooking Tax Deductions

Taxable components such as income tax, professional tax, or TDS are frequently ignored when estimating take-home pay. Neglecting these deductions can result in a significant difference between expected and actual salary, leading to budgeting issues.

Misunderstanding Variable Pay

Variable pay, including performance bonuses, incentives, or commissions, is often included in CTC but not guaranteed monthly. Treating it as fixed salary can lead to overestimating monthly earnings, especially if targets or performance metrics are not met.

By being aware of these common mistakes, employees can better interpret their CTC, plan their finances accurately, and make informed decisions when evaluating job offers or negotiating salaries.

Who Should Use a CTC Calculator?

A CTC (Cost to Company) calculator is a valuable tool for anyone who wants to understand salary structures, plan finances, or manage payroll efficiently. The following groups can benefit the most:

Job Seekers Evaluating Offers

Job seekers often receive multiple offers with varying salary structures. A CTC calculator helps them break down each offer, understand take-home pay versus total CTC, and compare benefits accurately, enabling informed career decisions.

Employees Planning Finances

For current employees, understanding CTC is crucial for budgeting and financial planning. By calculating the exact in-hand salary, deductions, and benefits, employees can manage monthly expenses, plan investments, and prepare for tax obligations effectively.

HR Professionals

HR teams use CTC calculators to streamline payroll processes. The tool ensures accurate salary computations, statutory compliance, and helps HR professionals generate salary slips or offer letters without manual errors.

Recruiters and Payroll Managers

Recruiters and payroll managers can use CTC calculators to structure offers, evaluate compensation packages, and manage payroll efficiently. It ensures consistency across the organization and avoids disputes related to salary miscalculations.

Freelancers Transitioning to Salaried Roles

Freelancers moving to full-time employment may be unfamiliar with salary structures like basic, HRA, PF, and variable pay. A CTC calculator helps them understand the total value of their compensation, plan their finances, and make better-informed career choices.

A CTC calculator is not just a tool for employees—it’s essential for HR, recruiters, and anyone navigating salary offers or payroll, providing clarity, accuracy, and transparency in compensation planning.

Frequently Asked Questions (FAQs)

Not sure what’s included in your salary or how your take-home pay is calculated? Check out these quick FAQs to clear common doubts about CTC, gratuity, bonuses, and taxes.

Legal & Disclaimer

The calculations and results displayed on this page are indicative estimates only. While we strive to provide accurate information based on current laws and common practices, actual salaries, gratuity, and benefits may vary depending on your employer’s policies, employment contracts, and local regulations.

Key points to keep in mind:

- The results shown are estimates and should not be considered as guaranteed payouts.

- Actual salary and gratuity may differ based on company-specific rules, performance-linked bonuses, or variable pay components.

- Tax laws and statutory regulations may change over time, affecting deductions and final take-home amounts.

- Always verify calculations with your HR department, payroll team, or a certified financial advisor before making any financial decisions.

This tool is designed for informational purposes only and does not constitute legal, tax, or financial advice.

Conclusion

Understanding your CTC (Cost to Company) is crucial for knowing the true value of your compensation. It goes beyond just the take-home salary, giving you a complete picture of all salary components, including basic pay, allowances, bonuses, and employer contributions like PF and gratuity.

- CTC reflects your total compensation, not just what you receive in-hand.

- Take-home salary is only one part of your overall package.

- A CTC calculator saves time, ensures accuracy, and provides clarity, making it easier to plan finances and evaluate job offers.

Use our free CTC Calculator to instantly break down your salary, understand your real earnings, and make informed career and financial decisions.