Calculate Your Dearness Allowance

Get an accurate calculation of your Dearness Allowance (DA) based on your basic salary and current DA rate.

Dearness Allowance Calculator

Dearness Allowance Breakdown

₹ 0

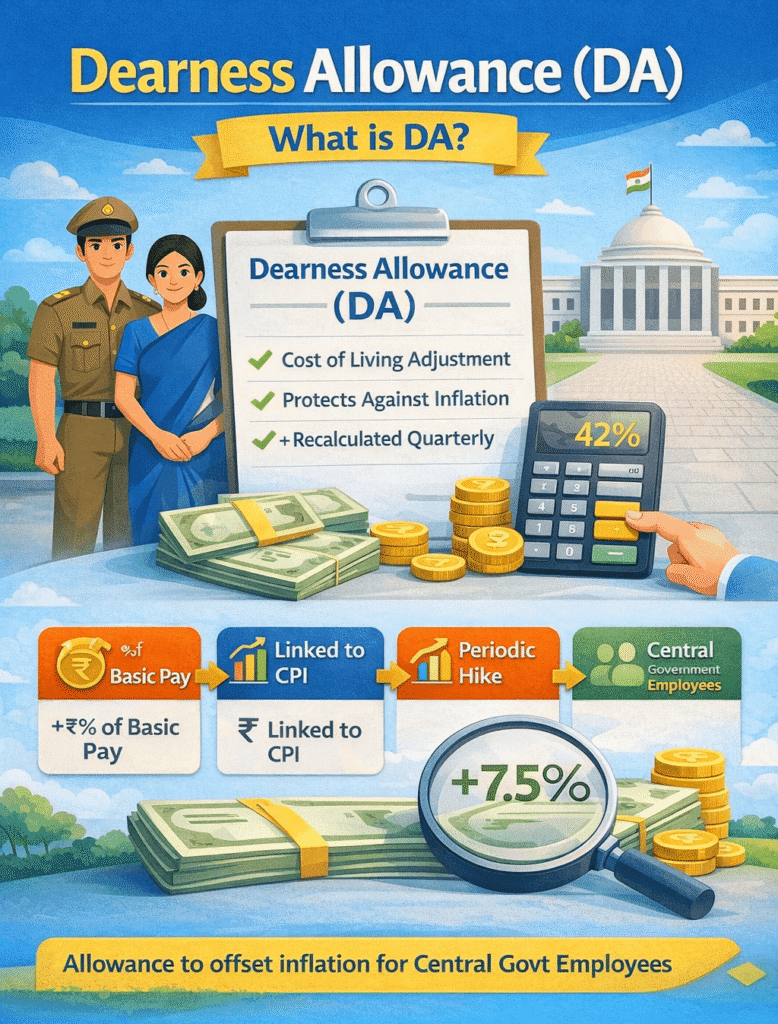

Dearness Allowance (DA) is a vital component of the salary structure for government and public sector employees. It is a cost-of-living adjustment paid in addition to basic salary, designed to help employees cope with rising prices and inflation.

The primary purpose of Dearness Allowance is to offset the impact of inflation on salaries. As the cost of essential goods and services increases over time, DA ensures that employees’ purchasing power is protected and their real income does not erode. This makes DA an important mechanism for maintaining financial stability, especially during periods of high inflation.

Dearness Allowance is typically provided to Central and State Government employees, public sector undertaking (PSU) workers, and pensioners. The rate of DA is revised periodically based on inflation trends, ensuring compensation remains fair and up to date. Calculate your Dearness Allowance instantly using our DA Calculator and understand how inflation impacts your salary or pension in real time.

What Is Dearness Allowance (DA)?

Dearness Allowance (DA) is calculated as a percentage of basic salary and revised at regular intervals based on officially published inflation data. Its value changes over time and is linked to economic indicators rather than individual performance or company policy.

Difference Between Basic Salary and DA

Basic salary is a fixed pay component that forms the foundation of an employee’s compensation. Dearness Allowance, however, is a dynamic component that fluctuates with inflation rates. While basic pay remains stable for long periods, DA is periodically adjusted to reflect changes in economic conditions.

How DA Protects Purchasing Power

DA acts as an inflation buffer by increasing pay in proportion to rising consumer prices. When inflation rises, DA rates are increased to compensate for higher expenses, helping employees maintain a consistent standard of living without requiring changes to their base pay.

Importance of DA in the Salary Structure

Within the salary structure, DA improves income predictability and financial continuity. It influences overall earnings, affects pension calculations, and in certain cases impacts other statutory benefits. By separating DA from basic pay, governments can adjust compensation efficiently without restructuring entire salary frameworks.

Who Is Eligible for Dearness Allowance?

Eligibility for Dearness Allowance (DA) is defined by government pay rules and applicable labor regulations. DA is granted only to specific groups of employees and beneficiaries who fall under structured, inflation-linked compensation frameworks.

Eligible Categories Include:

The following groups are entitled to receive Dearness Allowance based on their employment or pension status:

- Central Government Employees

Employees working under the Central Government receive DA as part of their regular pay structure. The allowance is revised periodically and applied uniformly across eligible departments and services. - State Government Employees

State Government employees are eligible for DA, although the applicable percentage and revision schedule may differ depending on state-specific policies and financial considerations. - Public Sector Undertakings (PSUs)

Employees working in PSUs may receive DA or Industrial Dearness Allowance (IDA), depending on the compensation model followed by the organization and relevant government guidelines. - Pensioners and Family Pensioners

Pensioners and family pensioners are entitled to DA on their pension amounts. This adjustment helps maintain the real value of pension income over time.

Exclusions

Although DA covers a broad range of government-linked employment, it is not applicable to all workers.

- Private Sector Employees are generally excluded from DA unless their employment contract or wage structure specifically includes a dearness allowance component.

Types of Dearness Allowance

Dearness Allowance is classified into different types based on the nature of employment and the method used to adjust wages for inflation. These variations ensure that different categories of workers receive inflation protection suited to their pay structure and industry.

Industrial Dearness Allowance (IDA)

Industrial Dearness Allowance (IDA) is designed for employees working in Public Sector Undertakings (PSUs) and certain government-controlled enterprises. Unlike standard DA, IDA follows a more frequent revision cycle to closely track changes in living costs.

- Applicable to PSU employees working under IDA-based pay scales

- Revised quarterly, allowing quicker adjustments to inflation

- Linked to the Consumer Price Index for Industrial Workers (CPI-IW), ensuring accurate inflation measurement

Variable Dearness Allowance (VDA)

Variable Dearness Allowance (VDA) is primarily intended for workers earning minimum wages, especially in sectors where pay structures are less formal. It helps protect low-income workers from rising living costs.

- Applicable to minimum wage workers across various industries

- Revised every six months based on inflation trends

- Commonly used in private and unorganized sectors, as notified by labor authorities

How Dearness Allowance Is Calculated

The calculation of Dearness Allowance (DA) is based on officially published inflation data rather than individual salary negotiations. Government authorities periodically revise DA to reflect changes in the cost of living, ensuring compensation remains aligned with economic conditions.

Overview of the DA Calculation Method

DA is calculated as a percentage of an employee’s basic salary. This percentage is derived using inflation indicators and revised at regular intervals. The revised DA rate is then applied uniformly to all eligible employees and pensioners.

Role of the Consumer Price Index (CPI)

The Consumer Price Index (CPI) measures changes in the prices of essential goods and services over time. DA calculations rely heavily on CPI data, as it reflects real inflation levels faced by households. Different CPI series may be used depending on the category of employees, such as CPI for Industrial Workers (CPI-IW).

Base Year Concept in DA Calculation

The base year serves as a reference point for calculating inflation. CPI values are compared against the base year index to determine the extent of price increases. Any change in the base year requires recalibration of the DA formula to ensure accuracy and consistency.

DA Calculation Formula

Instead of using complex mathematics, DA is calculated using a standardized formula issued by government authorities. The formula converts inflation levels into a percentage that is applied to basic salary.

- The formula links CPI movement to DA percentage

- Higher inflation leads to a higher DA rate

- Lower inflation results in smaller or unchanged DA revisions

How Inflation Percentage Impacts DA

When inflation rises, CPI values increase, which directly raises the DA percentage. This ensures that salary adjustments keep pace with the increasing cost of living without altering the basic salary itself.

Example of DA Calculation

To understand how DA works in practice, consider a simple example using basic salary and the applicable DA rate.

- Basic salary: ₹30,000

- Current DA rate: 50%

DA Amount:

₹30,000 × 50% = ₹15,000

In this example, the employee receives ₹15,000 as Dearness Allowance, which is added to the basic salary to determine the total gross pay.

DA Rates – Latest Updates 2026

Dearness Allowance (DA) is revised periodically to protect employees and pensioners from inflation. The latest updates for 2026 reflect adjustments based on changes in the cost of living, ensuring salaries and pensions retain their purchasing power.

Current DA Percentage for Central Government Employees

As of 2026, the DA rate for Central Government employees and pensioners is around 59–60% of basic pay. This percentage is applied to the basic salary to determine the DA component in total compensation.

DA Revision Schedule

DA is revised twice a year to align with inflation trends:

- January revision – Based on the previous half-year’s inflation data

- July revision – Based on the first half of the year’s inflation data

This schedule ensures salaries and pensions are adjusted regularly to reflect cost-of-living changes.

Historical DA Trend (Recent Years)

Over the past few years, DA has gradually increased:

- 2023: 52% of basic pay

- 2024: 55% of basic pay

- 2025: 58% of basic pay

- 2026: ~59–60% of basic pay

This trend shows the consistent effort to safeguard employees’ and pensioners’ incomes against inflation.

State-Wise DA Variations

While Central Government DA rates apply uniformly nationwide for central employees, state government employees may have different DA rates and revision schedules depending on local policies.

Dearness Allowance vs Other Salary Components

Dearness Allowance (DA) is a unique component of salary designed specifically to offset the impact of inflation. Unlike other salary components, it is directly linked to cost-of-living indices and revised periodically. Understanding how DA differs from other elements of a salary structure helps employees evaluate their total compensation accurately.

| Salary Component | Purpose | Calculation / Basis | Key Difference from DA |

|---|---|---|---|

| Dearness Allowance (DA) | Adjust salary for inflation; protect purchasing power | Percentage of Basic Pay, revised periodically based on CPI | Inflation-linked; increases automatically; separate from basic pay |

| House Rent Allowance (HRA) | Provide support for housing expenses | Fixed amount or % of Basic Pay; may depend on city classification | Depends on rent paid; not linked to inflation |

| Basic Pay | Core fixed salary; forms the base for other allowances | Fixed monthly amount as per employment terms | Static; does not change with inflation |

| Special Allowances | Reward skills, performance, or specific job roles | Fixed or variable based on company policy | Performance/job-based; not automatically linked to CPI |

Taxability of Dearness Allowance (DA)

Understanding the taxability of Dearness Allowance (DA) is crucial for both salaried employees and pensioners. Since DA forms part of your salary or pension, it affects your total taxable income and overall tax liability. Knowing how it is treated under the Income Tax Act helps in proper financial planning and avoids surprises during tax filing.

Whether DA Is Taxable

DA is generally considered a part of salary for employees or a component of pension for retirees. As such, it is included in gross income for taxation purposes. For most individuals, DA is fully taxable, though certain government-specific pension provisions may exempt a portion of DA for retired employees.

- Salaried employees: DA is fully added to taxable salary.

- Pensioners: DA may be partially or fully taxable depending on total pension amount and exemption rules.

DA Treatment Under Income Tax Act

The Income Tax Act treats DA as part of salary income, meaning it is subject to standard tax rates applicable for the financial year. It is not eligible for typical exemptions or deductions like HRA or allowances under section 10, because it is purely an inflation-linked adjustment.

- Included in gross salary or pension for calculating taxable income.

- Subject to applicable tax slabs and rates.

- Does not enjoy exemptions like certain allowances.

DA for Salaried Employees vs Pensioners

The way DA is taxed can differ depending on whether you are an active employee or a pensioner. While active employees see DA added to their monthly salary and taxed as part of payroll, pensioners may receive DA on a monthly or annual basis, and its taxability can vary depending on the total pension and government rules.

- Salaried employees: DA combined with basic pay, HRA, and other allowances forms the gross taxable salary.

- Pensioners: Taxability depends on pension rules; some DA may be exempt if within government-prescribed limits.

Impact of DA on Total Taxable Income

Since DA is tied to inflation, any increase in DA raises the gross salary or pension, which in turn affects your total taxable income. Understanding this impact helps in tax planning and ensures that individuals do not underpay or overpay taxes throughout the financial year.

- Higher DA can increase taxable income and affect tax slabs.

- Proper accounting of DA is important for accurate income tax calculation.

- Helps employees and pensioners plan deductions, investments, and savings.

Impact of DA on Salary, PF, and Gratuity

Dearness Allowance (DA) plays a significant role in shaping an employee’s overall compensation. While it primarily serves as an inflation adjustment, DA can also influence other key components of salary, including gross salary, provident fund contributions, and gratuity. Understanding its impact helps employees and pensioners plan finances accurately and make informed decisions regarding savings and retirement benefits.

Effect of DA on Gross Salary

DA is added to the basic pay to determine an employee’s gross salary. Since gross salary forms the basis for taxation and other salary-linked benefits, any increase in DA directly increases take-home salary before deductions. This ensures that employees maintain their purchasing power even when inflation rises.

- DA is a direct component of gross salary.

- Higher DA leads to a higher overall salary figure before deductions.

- Influences income tax calculation as gross salary increases with DA.

Whether DA Is Included in PF Calculation

The role of DA in Provident Fund (PF) contributions depends on the type of employee and organizational policy. For many government and PSU employees, DA is considered part of the basic pay for PF calculation purposes, meaning both employee and employer contributions may include DA. For private sector employees, it may vary based on the company’s PF rules.

- DA may be included in PF calculation as part of “basic + DA.”

- Employee and employer contributions can increase if DA increases.

- Not all organizations include DA in PF; company policy and statutory guidelines determine inclusion.

Role of DA in Gratuity Calculation (When Applicable)

In some cases, DA forms part of the gratuity calculation, especially when the formula considers “basic pay + DA” for end-of-service benefits. Using a gratuity calculator helps employees see exactly how DA impacts their total gratuity, ensuring the inflation-adjusted portion of salary is accurately reflected and providing better financial protection for long-serving employees.

- Gratuity = [(Basic + DA) × 15/26] × Years of Service (for India example).

- DA inclusion increases total gratuity payout.

- Provides a realistic reflection of inflation-adjusted salary in retirement benefits.

Long-Term Financial Impact

The inclusion and revision of DA have long-term financial implications:

- Sustained increases in DA help employees maintain real purchasing power over years.

- Contributes to higher PF accumulation if included in contributions.

- Enhances gratuity and pension benefits, offering better security after retirement.

- Affects overall salary structure, planning, and tax liability over an employee’s career.

Why Use an Online DA Calculator?

Understanding your Dearness Allowance (DA) and its impact on salary, provident fund, and gratuity can be complex, especially with periodic revisions and varying formulas. An online DA calculator simplifies this process, providing instant, accurate results without the need for manual computation. Using a calculator helps employees, pensioners, and HR professionals save time and make informed decisions about their finances.

Benefits of Using a DA Calculator

A Dearness Allowance (DA) calculator is a powerful tool for employees, pensioners, and HR professionals. It simplifies complex calculations and provides clarity on salary and benefits. Using an online DA calculator offers several advantages:

- Instant and accurate calculations: Quickly determine your DA amount based on current rates and salary structure.

- Eliminates manual errors: Avoid mistakes that can occur when calculating DA manually.

- Helps employees plan finances: Understand how DA affects gross salary, take-home pay, and long-term benefits.

- Useful for HR and payroll teams: Streamline payroll processing and ensure compliance with statutory revisions.

- Ideal for pensioners and job seekers: Easily estimate DA for retirement planning or comparing job offers.

“Use our free DA Calculator to get accurate results in seconds.”

Common Mistakes While Calculating DA

Calculating Dearness Allowance (DA) may seem simple, but many employees and pensioners make errors that lead to incorrect estimates. These mistakes can affect payroll, tax calculations, and retirement benefits. Understanding the most frequent pitfalls helps ensure accurate DA computation and avoids unnecessary discrepancies.

Common Mistakes to Avoid

While calculating DA, it’s easy to make errors if you are not careful. Here are some of the most common mistakes that employees, pensioners, and even HR professionals often encounter:

- Using outdated DA percentage: DA rates are revised periodically based on the Consumer Price Index (CPI). Using old rates can lead to underestimation or overestimation of your DA.

- Ignoring base year changes: The DA calculation is linked to the base year of CPI. Failing to adjust for updates in the base year can produce inaccurate results.

- Confusing DA with other allowances: DA is often mistakenly considered part of HRA, special allowance, or other benefits. This leads to errors in gross salary and taxable income calculations.

- Not accounting for salary revisions: DA is calculated on the current basic salary. If an employee’s basic pay has been revised, failing to update the calculation can result in incorrect DA figures.

Frequently Asked Questions (FAQs)

Below are answers to common questions about Dearness Allowance and how it affects your salary.

Legal Disclaimer

The calculations and figures provided for Dearness Allowance (DA) are intended for informational purposes only. While every effort is made to ensure accuracy, DA rates are subject to periodic revisions and may vary based on government notifications, departmental policies, and individual employment terms. Users should treat these calculations as estimates, not definitive values.

Important Points to Note

When reviewing your Dearness Allowance (DA), it is essential to keep in mind several key points to ensure clarity and avoid misunderstandings.

- DA calculations are indicative: The amounts shown are based on current rates and formulas, but actual payments may differ.

- Rates may change based on government notifications: DA is revised periodically, typically twice a year, depending on inflation and CPI changes.

- Actual salary may vary by department and policy: Different government departments or organizations may have specific rules affecting DA computation.

- Always confirm with official circulars or HR: For accurate and legally binding information, refer to official notifications or consult your HR department.

Conclusion

Dearness Allowance (DA) is a crucial component of an employee’s compensation, designed to protect purchasing power against inflation. Understanding how DA is calculated, its impact on gross salary, provident fund, and gratuity, and staying updated with periodic revisions ensures that employees and pensioners can make informed financial decisions.

Calculating DA accurately is important not only for personal financial planning but also for understanding the complete salary structure. Whether you are a government employee, pensioner, or part of a public sector organization, having clarity on DA helps avoid confusion and ensures fair compensation.

“Use our Dearness Allowance Calculator to instantly calculate your DA and understand your real salary.”