Accurate Gratuity Calculation Formula for India, UAE & US

Quickly understand and apply the Gratuity Calculation Formula for India, UAE & US with examples and helpful tips.

When it comes to planning your finances at the end of your employment, understanding the Gratuity Calculation Formula is essential. Gratuity is an end-of-service benefit provided by employers to reward employees for their long-term service and loyalty. Whether you are resigning, retiring, or transitioning to a new job, knowing how gratuity is calculated helps you estimate your rightful entitlement and plan your financial future confidently.

While gratuity is a statutory benefit in some countries, employees in service industries—especially in the US—often rely on tips or voluntary gratuity payments from customers. Understanding the difference between these payments and formal gratuity ensures that employees receive all the benefits they are legally or contractually entitled to.

The rules and formulas for calculating gratuity vary widely from country to country:

- India: Gratuity is governed by the Payment of Gratuity Act, 1972, applicable to employees with five or more years of continuous service.

- UAE: Employees completing one year or more of service are entitled to gratuity under the UAE Federal Labour Law, with calculations based on basic salary and length of service.

- US: There is no statutory end-of-service gratuity in most sectors. Instead, employees often depend on tips or service-based gratuity, particularly in restaurants and hospitality.

This page not only explains the Gratuity Calculation Formula for India and UAE but also provides guidance on tip calculations in the US, helping you understand how to maximize your end-of-service benefits or service earnings.

Use our free online gratuity calculator to instantly calculate your entitlement for India, UAE, or US tips and see how much you could receive.

Understanding Gratuity vs Tip

Gratuity and tips are both forms of additional compensation that employees may receive, but they are fundamentally different in purpose, calculation, and legal framework. Understanding these differences is essential for employees, employers, and anyone working in service industries. Proper knowledge ensures accurate financial planning and prevents payroll mistakes.

This section also introduces the Gratuity Calculation Formula, which is used in countries like India and UAE to calculate statutory end-of-service benefits.

What is Gratuity?

Gratuity is a financial benefit paid by the employer to employees who have served the organization for a minimum period. It acts as a reward for loyalty and long-term servic and provides financial support when leaving the company.

Gratuity is legally mandated in some countries (like India and UAE), and failure to pay it can result in penalties for the employer.

Key Features of Gratuity:

- Paid by the employer.

- Formula-based, depending on salary and tenure.

- Eligible employees typically meet a minimum service requirement (e.g., 5 years in India, 1 year in UAE).

- Paid at the end of service—resignation, retirement, or termination.

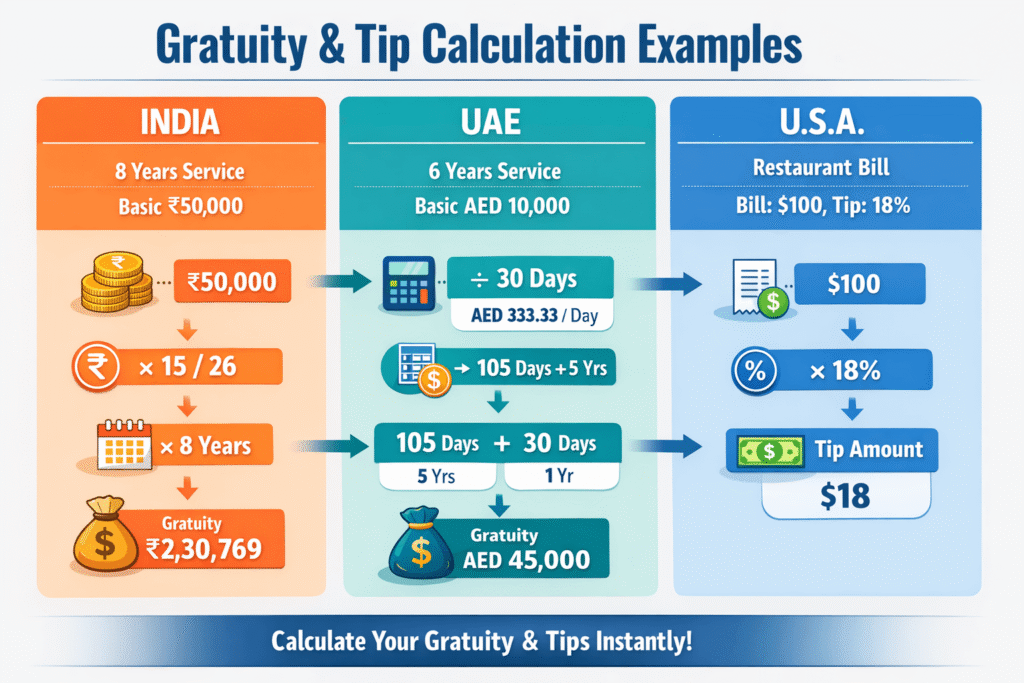

Gratuity Calculation Formula Examples:

India:

Gratuity=(Last Drawn Basic Salary×15/26)

×Number of Years of Service

Example: Last drawn basic ₹50,000, 8 years of service →

(50,000×15/26)×8=₹2,30,769

UAE:

- 1–5 years: 21 days’ basic salary per year

- More than 5 years: 30 days’ basic salary per year for service beyond 5 years

(10,000×21/30×5)+(10,000×30/30×1)=45,000 AED

What is a Tip?

A tip is a voluntary payment given by a custome to reward good service, most commonly in restaurants, cafes, hotels, and other service industries. Unlike gratuity, tips are not guaranteed and are not mandated by law in most countries.

Key Features of Tips:

- Paid by customers, not the employer.

- Usually calculated as a percentage of the bill (common rates: 10%, 15%, 18%, or 20%).

- Can be direct (paid to a single employee) or pooled/shared among staff.

- Often taxable income for employees.

Example (US Restaurant):

- Bill: $120

- Tip: 15%

Optional Tip Notes:

- In some cases, restaurants add a mandatory gratuity for large parties, functioning like a pre-calculated tip.

- Employees in the US or service industries may rely heavily on tips as part of their monthly earnings.

Key Differences Between Gratuity and Tip

| Feature | Gratuity | Tip |

|---|---|---|

| Paid by | Employer | Customer |

| Mandatory | Yes (in statutory countries) | No (voluntary) |

| Based on | Tenure & Salary | Bill Amount / Percentage |

| Eligibility | Minimum years of service | Anyone providing service |

| Taxable | Depends on country | Usually taxable |

| Example | India: Last basic × 15/26 × Years | US: $100 × 15% = $15 |

Why Understanding the Difference Matters

Understanding the differences between gratuity and tips is critical for:

1. Employees:

- Ensure full entitlement to statutory benefits.

- Plan finances effectively for resignation, retirement, or career transitions.

- Avoid confusion between voluntary tips and employer-provided gratuity.

2. Employers:

- Maintain legal compliance and avoid penalties for incorrect gratuity payments.

- Clearly separate mandatory gratuity from voluntary tips in payroll systems.

3. Service Industries:

- Accurate tip calculation prevents internal disputes among staff.

- Ensures transparency in employee compensation and taxation.

How Gratuity and Tips Work Together

While gratuity and tips are separate concepts, understanding both is important for total compensation planning, especially for service industry employees:

- Gratuity: Formula-based, guaranteed in statutory countries like India and UAE.

- Tips: Voluntary, customer-driven, supplement income in countries like the US.

By using the Gratuity Calculation Formula, employees can calculate their statutory end-of-service benefits. By combining this with estimated tip earnings, service workers can get a complete picture of their total potential income.

Gratuity Calculation in India

Gratuity is a statutory end-of-service benefit in India, designed to reward employees for long-term service and loyalty. Governed by the Payment of Gratuity Act, 1972, it is mandatory for eligible employees in the private sector and certain public organizations. Understanding the Gratuity Calculation Formula, eligibility criteria, and step-by-step calculation is crucial for both employees and employers to ensure compliance and accurate payouts.

Eligibility

Before calculating gratuity, it is important to know who is eligible to receive it. Eligibility ensures that the employee meets the minimum legal requirements and clarifies the conditions under which gratuity must be paid.

Employees in India can claim gratuity if they satisfy the following conditions:

Minimum Service Requirement:

To qualify, employees must have completed at least 5 years of continuous service with the employer. This period is calculated from the joining date to the date of resignation, retirement, or termination. In cases of death or permanent disability, gratuity is payable regardless of the number of years served.

Applicable Employees:

Gratuity applies to private-sector employees, including those working in factories, offices, and organizations, where the basic salary is ₹21 lakh per year or less (as per the latest amendment).

Employment Status:

Gratuity is payable under several circumstances:

Resignation: Eligible only if the employee has completed 5 years of service.

Retirement: All retiring employees are eligible, irrespective of tenure.

Termination: Employees terminated for reasons other than misconduct are eligible; those dismissed for misconduct may forfeit gratuity.

Exclusions: Certain categories of employees, such as temporary, contractual, or casual workers, may not be covered under the Act unless specified by company policy.

Gratuity Formula

Once eligibility is confirmed, the next step is to understand the Gratuity Calculation Formula, which ensures a fair and formula-based payout.

The Gratuity Calculation Formula in India is:

Gratuity=(Last Drawn Basic Salary×15/26)

×Number of Years of Service

Explanation of Formula Components:

Before applying the formula, it is important to understand each element:

- Last Drawn Basic Salary: The basic salary of the employee at the time of leaving the organization.

- 15: Represents 15 days of salary for every completed year of service.

- 26: Number of working days in a month considered for calculation.

- Number of Years of Service: Total completed years of employment. Some organizations may calculate proportionate gratuity for partial years.

This formula ensures that the gratuity payout is directly proportional to tenure and salary, providing fair compensation for long-term employees.

Step-by-Step Example

Understanding the formula becomes easier with a numerical example. Let’s calculate gratuity for an employee in India:

Scenario:

- Last Drawn Basic Salary = ₹50,000

- Years of Service = 8

Step 1: Calculate 15 days’ salary

Step 2: Multiply by number of years of service

Result:

Explanation:

- The first step calculates the equivalent of 15 days of salary, which is then multiplied by the number of completed years to determine the final gratuity.

- This ensures proportional rewards for employees based on both tenure and salary.

Important Notes

While the formula gives the basic calculation, there are several key points to consider when calculating gratuity:

Maximum Limit:

As per the latest amendment, gratuity is capped at ₹20 lakh. Even if the formula produces a higher amount, the payout cannot exceed this limit.

Partial Years:

Employees who have completed partial years of service may receive proportionate gratuity, depending on employer policy.

Forfeiture:

Gratuity can be forfeited or reduced if the employee is terminated for misconduct, fraud, or violation of company policies.

Death or Disability:

In the event of employee death or permanent disability, gratuity is payable regardless of tenure.

Taxability:

Gratuity is tax-exempt up to certain limits under the Income Tax Act.

Any amount exceeding the exempt limit may be taxable depending on the employee’s salary and tenure.

Employer Compliance:

Companies must maintain records and ensure accurate calculation to avoid legal disputes or penalties.

Practical Tips for Employees

Knowing the eligibility and calculation formula is helpful, but employees can take further steps to maximize their benefits and ensure accuracy:

- Verify Salary Details: Always check your last drawn basic salary before calculation.

- Check Tenure: Confirm the number of completed years of service, including partial years if applicable.

- Use Online Gratuity Calculators: These tools automatically compute gratuity using the official formula, reducing calculation errors.

- Understand Company Policy: Some companies may offer gratuity above the statutory minimum, as part of employee benefits.

- Plan Your Finances: Gratuity is a lump-sum payment, so consider using it for savings, investments, or important expenses.

Gratuity in India is a mandatory end-of-service benefit that rewards employees for their loyalty and long-term service. By understanding the eligibility criteria, the Gratuity Calculation Formula, and step-by-step computation, employees can accurately estimate their entitlement.

Key points to remember:

- Gratuity is based on last drawn basic salary and years of service.

- Maximum limit is ₹20 lakh.

- Forfeiture and tax rules may apply in certain circumstances.

- Using the Gratuity Calculation Formula and examples ensures clarity and proper planning.

Calculate your gratuity instantly using our Gratuity calculator and know your entitlement in India, based on your salary and years of service.

Gratuity Calculation in UAE

Gratuity in the UAE is an end-of-service benefit provided to employees when they leave their job. Unlike India, where gratuity eligibility starts after 5 years, the UAE allows employees to claim gratuity after completing just 1 year of continuous service. The calculation is regulated by the UAE Federal Labour Law (Law No. 8 of 1980) and is based primarily on the employee’s basic salary. Understanding the eligibility, formula, and step-by-step calculations is crucial for both employees and employers to ensure accurate payouts.

Eligibility

Eligibility defines who can claim gratuity and under what conditions. This ensures that employees are correctly compensated for their service while allowing employers to remain compliant with the law.

In the UAE:

- Minimum Service Requirement: Employees must complete at least 1 year of continuous service to qualify for gratuity. Service of less than 1 year generally does not count, except in cases of death or permanent disability.

- Governing Law: Gratuity entitlement is regulated under the UAE Federal Labour Law, Law No. 8 of 1980, which outlines the minimum benefits and maximum limits.

- Employment Status: Employees who resign, retire, or are terminated (without gross misconduct) are generally eligible. Termination for gross misconduct may result in forfeiture of gratuity.

- Salary Basis: Only the basic salary is considered for calculating gratuity, unless an employment contract explicitly includes allowances, bonuses, or other components.

Gratuity Formula

The formula defines how gratuity is calculated based on tenure. In the UAE, the benefit increases slightly for employees who have served more than 5 years, and there is a maximum limit to ensure fairness.

The UAE Gratuity Formula is:

For employees with 1–5 years of service:

For employees with more than 5 years of service:

Gratuity=(Basic Salary×3021×5)

+

(Basic Salary×3030×(Years of Service−5))

Maximum Limit:

The gratuity payout cannot exceed 2 years’ basic salary, regardless of total tenure.

Explanation:

- The first 5 years are calculated at 21 days per year.

- Any additional years beyond 5 are calculated at 30 days per year.

- Only the basic salary is included unless the employment contract specifies otherwise.

Step-by-Step Example

Step 1: First 5 years (21 days per year)

Daily salary

Basic Salary ÷ 30 = 10,000 ÷ 30 = AED 333.33/day

Gratuity for first 5 years:

Step 2: Year beyond 5 (30 days per year)

Step 3: Total gratuity

Explanation:

- The first 5 years are calculated at 21 days’ salary per year.

- The additional year beyond 5 is calculated at 30 days’ salary.

- This method ensures employees with longer service are compensated proportionally for the extra years.

Important Notes

Understanding the key points ensures that employees know their full rights and employers comply with the law.

- Resignation Before 1 Year: Employees who resign before completing 1 year are not entitled to gratuity.

- Termination for Misconduct: If terminated for gross misconduct, the employee may forfeit gratuity entirely.

- Salary Basis: Only the basic salary is considered for calculation unless the employment contract includes allowances or other components.

- Maximum Cap: Gratuity cannot exceed 2 years’ basic salary, even for long-serving employees.

- Partial Years: Employers may calculate pro-rata gratuity for incomplete years, depending on company policy.

Practical Tips for Employees

Knowing eligibility and formula is not enough; employees should also take practical steps to ensure they receive their full gratuity:

- Verify Basic Salary: Ensure your basic salary is accurately recorded in payroll.

- Check Employment Duration: Maintain records of joining date, resignation or termination date to confirm years of service.

- Review Contract Terms: Some employers may offer additional benefits beyond statutory gratuity.

- Use Online UAE Gratuity Calculators: These calculators make computation quick, especially for 1–5 years vs. 5+ years scenarios.

Gratuity in the UAE is a mandatory end-of-service benefit that compensates employees for their service. By understanding eligibility, the formula, and step-by-step calculation, employees can estimate their gratuity accurately.

Key points to remember:

- Eligibility starts after 1 year of service.

- 21 days’ basic salary per year for the first 5 years; 30 days per year beyond 5 years.

- Maximum payout is 2 years’ basic salary.

- Gratuity may be forfeited in cases of gross misconduct.

- Only basic salary is considered unless contract specifies otherwise.

Calculate your UAE gratuity instantly using our Gratuity calculator UAE based on your basic salary and years of service.

Gratuity & Tip Calculation in the US

In the United States, gratuity as an end-of-service benefit is generally not mandated by law. Instead, the term “gratuity” is often used interchangeably with tips, which are voluntary payments made by customers to service workers. Tips form an important part of income for employees in restaurants, hospitality, and other service industries, and they are subject to taxation. Understanding how tips work, how to calculate them, and how they differ from statutory gratuity is essential for both employees and employers.

Overview

Unlike India or the UAE, the US does not require employers to provide a statutory gratuity when an employee leaves a job. Employees’ earnings from gratuity in the US are usually limited to tips in service industries.

Tips vs Gratuity:

- Tips are voluntary payments by customers to reward good service.

- Gratuity may sometimes refer to an automatic service charge added to a bill, especially for large groups, but this is not an employment termination benefit.

Taxability:

- Tips are considered taxable income and must be reported by employees on their IRS Form 1040.

- Employers are responsible for withholding Social Security, Medicare, and income tax on reported tips.

Importance: Understanding the distinction between voluntary tips and statutory gratuity ensures accurate payroll reporting and compliance with tax laws.

Tip Calculation Formula

The most common way service employees receive gratuity in the US is via tips, which are calculated based on the bill amount and a chosen tip percentage.

The standard formula is:

- Bill Amount: Total charge for food, service, or other items.

- Tip Percentage: Customer-chosen rate, commonly 10%, 15%, 18%, or 20%.

This simple formula allows both customers and employees to quickly determine the tip value.

Step-by-Step Example

Let’s calculate a tip using a typical restaurant scenario:

Scenario:

- Bill Amount = $100

- Tip Percentage = 18%

Step 1: Convert percentage to decimal

Step 2: Multiply by bill amount

Step 3: Result

Explanation:

- This $18 is paid voluntarily by the customer to the service staff.

- Employees include this amount as part of taxable income.

- For larger bills or special events, restaurants may add automatic service charges, which are also taxable.

Important Notes

Even though gratuity is not mandated in the US, there are key points to understand for accurate tip handling:

Automatic Gratuity for Large Groups:

- Many restaurants add a service charge (gratuity) automatically for parties of 6–20 people.

- This amount is distributed to staff and is considered taxable income.

Reporting Tips for Taxes:

- Employees must report all tips to their employer for income tax purposes.

- Tips are subject to federal and state taxes, as well as Social Security and Medicare contributions.

Cash vs Non-Cash Tips:

- Tips can be cash, credit card, or digital payments.

- All tips must be reported, regardless of the payment method.

Tip Pooling:

- Some employers implement tip pooling, where tips are collected and redistributed among staff according to labor agreements or policies.

- Tip pooling must comply with US labor law.

Practical Tips for Employees

To make sure employees receive and report tips correctly:

- Track All Tips: Keep a daily record of cash and credit card tips.

- Understand Employer Policies: Know if your employer uses tip pooling or automatic service charges.

- Report Tips Accurately: Submit tips to your employer for tax reporting purposes.

- Calculate Tips Quickly: Use the formula Tip = Bill × Tip % to estimate your earnings.

In the US, gratuity is primarily voluntary, given as tips to reward service employees. There is no statutory gratuity for leaving employment, unlike India or UAE.

Key takeaways:

- Tips are voluntary payments, usually 10–20% of the bill.

- Tips are taxable income and must be reported.

- Some restaurants add automatic service charges for large groups.

- Understanding tips ensures accurate reporting, compliance, and fair compensation for employees.

Use our US tip calculator to instantly calculate tips for any bill and ensure proper reporting.

Step-by-Step Guide

Understanding how gratuity or tips are calculated can be confusing, especially when rules differ from country to country. This section walks you through practical examples for India, UAE, and the US, showing you exactly how to estimate your entitlement or tip quickly.

India – Estimating Gratuity

Consider an employee who has served 8 years and has a last drawn basic salary of ₹50,000. To estimate the gratuity, you start by looking at the last drawn basic and applying the standard adjustment for 15 days’ salary per year of service. Once you multiply this by the total number of completed years, you arrive at a total gratuity of ₹2,30,769. This method provides a quick estimation, letting employees get an immediate idea of what they might receive without diving into complex legal details.

UAE – Estimating Gratuity

In the UAE, the gratuity system differs slightly for employees who have served more than five years. Take, for example, an employee with 6 years of service and a monthly basic salary of AED 10,000. First, the daily salary is calculated by dividing the monthly basic by 30. For the first five years, 21 days’ salary is multiplied by five, and for the remaining one year, 30 days’ salary is added. The total gratuity in this case comes to AED 45,000. This stepwise approach ensures employees understand how years of service influence their end-of-service benefits.

US – Calculating Tips

Unlike India or the UAE, gratuity is not a statutory requirement in the US. Tips are voluntary payments made by customers and are usually calculated as a percentage of the bill. For instance, if the restaurant bill is $100 and the tip is 18%, you simply convert the percentage to a decimal and multiply it by the bill amount. This results in a tip of $18. This straightforward calculation is especially useful for service workers and customers who want to quickly determine a fair tip.

These examples provide a quick, practical understanding of gratuity and tip calculations across different countries. By following the steps outlined here, you can estimate your gratuity or tip without needing to reference complex laws or formulas. For a more interactive approach, using an online gratuity and tip calculator can provide instant results tailored to your situation.

Tips for Accurate Gratuity Calculation

Calculating gratuity correctly is essential to ensure employees receive the benefits they are entitled to and to avoid errors in payroll. The following guidance will help you approach gratuity and tip calculations accurately across different countries.

Maintain Up-to-Date Salary and Service Records

Accurate gratuity calculations depend heavily on having complete and current records of your salary and tenure. Ensure that your monthly basic salary, allowances, and service dates are correctly documented. Any discrepancies in records can lead to underpayment or disputes when calculating your end-of-service benefits. For employers, maintaining transparent records ensures compliance with local labor laws and prevents legal complications.

Include Allowances Where Legally Applicable

In some countries, certain allowances or components of salary may be included in the gratuity calculation if specified by law or employment contract. For example, in India, gratuity is generally calculated based on last drawn basic salary plus dearness allowance, if applicable. In the UAE, most gratuity calculations consider basic salary only, but contracts may specify additional components. Always verify local laws and employment agreements to ensure no eligible allowances are excluded.

Verify Resignation vs. Termination Rules

Gratuity entitlement can differ depending on how employment ends. In India and the UAE, employees who resign before completing the minimum required tenure may not be eligible for full gratuity, and in some cases, misconduct or termination for cause can lead to forfeiture. Understanding these distinctions is crucial. Make sure you check the local labor law provisions to know how resignation, retirement, or termination impacts your gratuity.

Leverage Online Gratuity Calculators

Online gratuity calculators can provide quick and reliable estimations without manual computation. They allow you to enter basic salary, years of service, and other relevant parameters to get instant results for India, UAE, or even US service scenarios. These tools are particularly useful for HR professionals or employees who want to double-check calculations before processing payroll or planning finances.

Consider Tax and Tip Rules for US Gratuity

In the US, gratuity as an end-of-service benefit is generally not mandatory, but tips are an important part of compensation in service industries. Accurate tip calculation includes not only computing the correct percentage of the bill but also reporting tips as taxable income and complying with tip pooling rules, if applicable. Employees and employers should ensure proper documentation and reporting to avoid IRS issues.

Accurate gratuity calculation starts with maintaining complete and up-to-date salary and service records, as any discrepancies can lead to underpayment or disputes. It is essential to verify which components of salary are legally included in the calculation, such as basic pay or allowances, depending on the country and employment agreement. Employees should also understand how different circumstances, like resignation, termination, or misconduct, can affect their eligibility for gratuity.

For quick and reliable estimations, using online gratuity calculators can be extremely helpful, allowing both employees and employers to double-check amounts before processing. In the US, special attention should be given to tips, ensuring proper reporting for tax purposes and adherence to any tip pooling arrangements. By following these best practices, employees can feel confident that they receive their full gratuity entitlement, while employers can maintain compliance with labor laws and avoid potential disputes.

Frequently Asked Questions (FAQ)

Conclusion

Gratuity is an important financial safeguard for employees, rewarding years of dedication and providing support during the transition between jobs. Understanding the Gratuity Calculation Formula is essential, as each country has its own rules, eligibility criteria, and formulas. Knowing the correct Gratuity Calculation Formula ensures employees receive their entitled benefits and helps employers remain compliant with labor laws.

In India, the Gratuity Calculation Formula is based on the employee’s last drawn basic salary and years of service, with statutory limits in place. Accurately applying the Gratuity Calculation Formula allows employees to know their exact entitlement upon resignation, retirement, or termination.

In the UAE, gratuity calculations also follow a specific Gratuity Calculation Formula, depending on the length of service. Different rates apply for the first five years and any additional years, and proper application of the formula ensures that employees receive the correct end-of-service benefits.

In the United States, gratuity as an end-of-service benefit is generally not required by law. Instead, tips play a significant role in supplementing income for service industry workers. While tips are voluntary, accurate calculation and documentation are important, and understanding the Gratuity Calculation Formula in the context of service charges and tips helps ensure fair compensation.

By understanding these country-specific rules and using the Gratuity Calculation Formula, individuals can ensure their compensation is fair and accurate. Online gratuity and tip calculators make it easier for employees and employers to quickly estimate gratuity amounts or tip values without manual computation, saving time and minimizing errors.

Calculate your gratuity instantly with our free online Gratuity Calculation Formula & tip calculator and get accurate results tailored for India, UAE, or US scenarios.