US Tax and Gratuity Calculator

Calculate exact amounts including tax, tip, and split bill among friends in seconds.

Restaurant Calculator

Your Total Payment

$127.00

Breakdown

Per Person

Gratuities, commonly known as tips, are an essential part of the service industry, especially in restaurants, bars, hotels, and other hospitality settings. For many employees, tips make up a significant portion of their income, which makes accurate calculation crucial for both staff and employers. A gratuity is a reward given by customers for quality service, and while tipping is often discretionary, understanding how to calculate it correctly ensures fairness and compliance with legal requirements.

Accurately calculating tips is important because gratuities are considered taxable income. Employees are required to report tips to the IRS, and taxes such as federal income tax, Social Security, and Medicare can affect the final amount received. Some states and localities may also have additional tax considerations. Miscalculations can lead to underreporting, payroll errors, or disputes between employees and employers, making a reliable calculation method essential.

A US tax and gratuity calculator simplifies this process by quickly computing tips and the associated taxes. Users can input the bill amount, tip percentage, number of diners, and any applicable taxes to get an accurate total in seconds. These tools are helpful for customers wanting to leave the right tip, for restaurant staff tracking earnings, and for managers ensuring proper reporting and fair distribution.

In restaurant scenarios, calculators can handle more complex situations, such as splitting a bill among multiple diners, including service charges, or calculating tips for large parties. This not only ensures accuracy but also saves time and reduces errors, making tip management easier for everyone.

Whether you are a diner wanting to leave a fair gratuity or an employee managing tips for tax purposes, a Tip calculator is an invaluable tool for accuracy, transparency, and convenience.

What Is Gratuity in the US?

Gratuity, or a tip, is a sum of money given directly to a service worker by a customer as a reward for good service. Unlike wages, which are guaranteed by an employer, gratuities are typically voluntary and reflect the customer’s satisfaction. While tipping culture is most common in restaurants and hospitality, it also applies in bars, hotels, salons, and other service industries. Legally, gratuities are considered taxable income, which means they must be reported to the IRS by employees, even if received in cash.

Difference Between Service Charges, Tips, and Wages

Understanding how gratuities differ from other forms of compensation is important:

- Tips: Voluntary payments made by customers directly to staff. Employees often have the option to pool or share tips among coworkers, depending on employer policy.

- Service Charges: These are mandatory fees automatically added to a bill by the business, often for large parties or special events. Unlike tips, service charges are considered revenue for the business and are distributed according to company rules.

- Wages: The regular pay provided by an employer, either hourly or salaried. Wages are fixed and subject to standard payroll deductions, separate from any tips or service charges.

This distinction is crucial because it affects how payments are recorded, taxed, and distributed among staff.

Federal and State Regulations on Reporting Tips

At the federal level, the IRS requires employees to report all tips received, whether in cash, credit card, or other forms. Employers are responsible for withholding income taxes, Social Security, and Medicare contributions based on reported tips. Failure to report tips can lead to fines, back taxes, or legal penalties.

State regulations may add additional requirements. Some states mandate tip pooling rules, require reporting for certain types of gratuities, or have stricter penalties for noncompliance. Restaurant owners and employees must understand both federal and local rules to ensure proper tax reporting and avoid disputes.

Importance for Restaurant Staff and Employers

For restaurant staff, gratuities often form a significant portion of income, making accurate tracking essential. Proper tip management ensures fair distribution among employees, prevents misunderstandings, and protects against tax issues.

For employers, correctly handling gratuities is equally important. It ensures compliance with federal and state laws, supports staff satisfaction, and avoids potential IRS audits or legal challenges. Tools like a restaurant tip calculator or a tax and gratuity calculator help both employees and employers calculate accurate amounts, manage tip pools, and streamline reporting.

Accurate understanding and management of gratuities benefit everyone: employees receive what they earn, employers stay compliant, and customers can be confident their contributions are distributed fairly.

Why Accurate Tip Calculation Matters

Proper tip calculation is more than just a courtesy—it has a direct impact on employees, employers, and customers in the restaurant and service industry. Getting gratuity calculations right ensures fairness, compliance, and financial clarity for everyone involved.

Impacts Employee Income and Tax Reporting

For many restaurant employees, tips represent a significant portion of their total earnings. Miscalculating gratuity can mean an employee receives less than they are entitled to or reports incorrect income to the IRS. Accurate tip tracking ensures that employees:

- Receive fair compensation for their service.

- Correctly report income on tax returns, avoiding penalties or back taxes.

- Maintain accurate records for payroll and personal financial planning.

Since tips are taxable, even small errors can have long-term consequences. Proper calculation ensures that employees meet legal obligations while keeping their earned income intact.

Ensures Compliance with IRS Rules

The IRS requires all tips to be reported, regardless of whether they are received in cash or via credit card. Accurate tip calculations help employees and employers comply with these rules by:

- Providing exact amounts for payroll withholding of federal income tax, Social Security, and Medicare.

- Avoiding penalties for underreporting or misreporting tips.

- Creating transparent records that can be verified during audits.

Failing to comply with IRS regulations can lead to fines, legal challenges, or disputes with tax authorities, making accuracy critical.

Avoids Disputes Between Staff and Customers

Incorrect tip calculations can create friction in restaurants. Staff may feel shortchanged if tips are miscalculated or improperly split, while customers may feel overcharged if service charges or gratuities are added incorrectly. Clear and precise calculations:

- Build trust between employees and management.

- Ensure customers pay exactly what they intend.

- Reduce misunderstandings related to service charges, bill splitting, or tip pooling.

Role of a Restaurant Gratuity Calculator in Simplifying Calculations

A restaurant gratuity calculator is an essential tool for simplifying the complex process of tip calculations. These digital tools can:

- Automatically calculate tips based on bill totals and preferred percentages.

- Include options for splitting bills among multiple diners.

- Factor in taxes and service charges for accurate reporting.

- Help employers track and distribute tips fairly among staff.

By using a gratuity calculator, both employees and customers save time, reduce errors, and ensure that all parties are satisfied. This not only improves operational efficiency in restaurants but also strengthens trust and transparency between staff, management, and diners.

How the US Tax and Gratuity Calculator Works

A US tax and gratuity calculator is a powerful tool designed to make tip and tax calculations fast, accurate, and hassle-free. It eliminates the need for manual math while ensuring that both employees and customers can correctly determine gratuity amounts and associated tax obligations. For restaurants, a restaurant gratuity calculator also helps manage tips fairly and transparently among staff.

Inputs Required

To generate accurate results, most calculators require a few simple inputs:

- Bill Amount: The total cost of the meal or service before tip calculation.

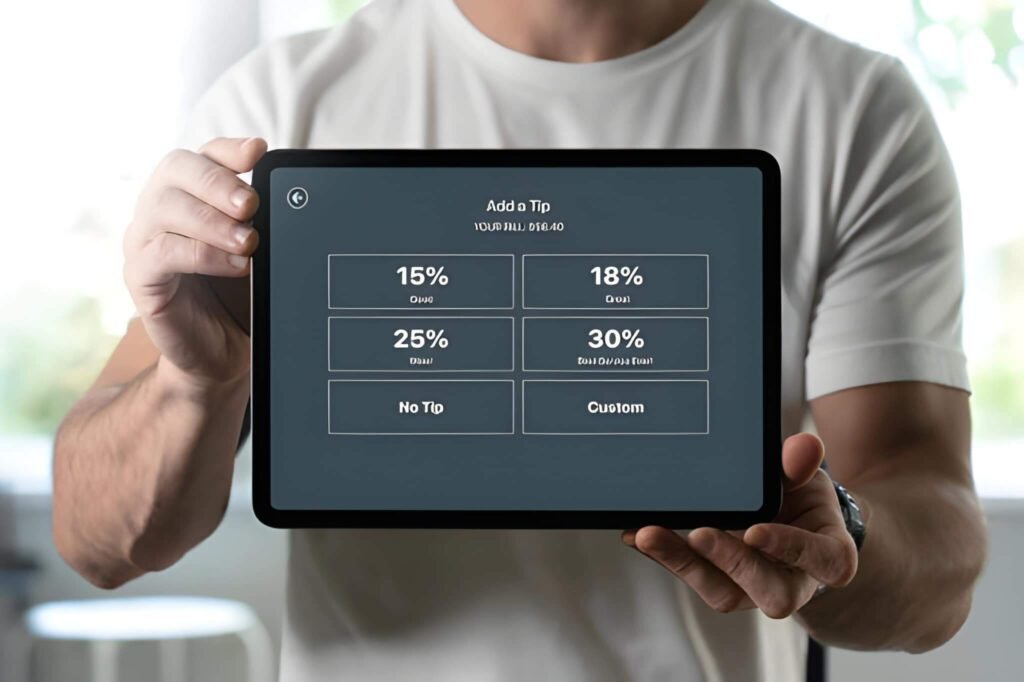

- Tip Percentage: The percentage of the bill you want to leave as a tip, typically ranging from 15% to 20% for standard service. Some calculators allow custom percentages for more flexibility.

- Applicable Federal, State, and Local Taxes: Including taxes ensures the total payment and tip calculations are accurate based on the location of the restaurant.

- Number of People Splitting the Bill (Optional): For groups dining together, this input divides the total amount, including tip and taxes, evenly among participants.

How the Calculator Works

Once the inputs are entered, the US tax and gratuity calculator automatically performs all calculations in real time:

- Determines the correct tip amount based on the chosen percentage.

- Calculates taxes according to federal, state, and local rules.

- Provides the total bill including taxes and tip.

- Breaks down per-person amounts if the bill is split among multiple diners.

For restaurants, a restaurant gratuity calculator can also factor in pooled tips or service charges, making it easy to allocate earnings fairly among staff.

Benefits of Using a Calculator Versus Manual Calculation

Using an online calculator has several advantages over traditional manual methods:

- Accuracy: Automatically applies percentages and tax rules, reducing human error.

- Speed: Instantly calculates total amounts and splits bills in seconds.

- Clarity: Provides a detailed breakdown of tips, taxes, and totals for transparency.

- Convenience: Removes the need for manual math, especially useful for large bills or complex group splits.

Mobile and Desktop-Friendly Use Cases

Most modern US tax and gratuity calculators are designed for both desktop and mobile use, allowing customers and staff to calculate tips anywhere:

- For customers: Quickly determine the right tip while dining out or splitting bills with friends.

- For restaurant staff: Track tips and service charges accurately, ensuring fair distribution among employees.

- For employers and managers: Simplify payroll processing by using calculator reports for tip tracking and tax reporting.

By automating calculations, the US tax and gratuity calculator and restaurant gratuity calculator save time, increase accuracy, and make tip management straightforward for everyone involved.

Calculating Tips in Restaurants: Step-by-Step Guide

Tipping is a fundamental part of the dining experience in the US, and understanding how to calculate tips correctly ensures fairness for both employees and customers. Whether you prefer to calculate manually or use a restaurant gratuity calculator, following a structured approach can save time and reduce errors.

Standard Tip Percentages in the US

In most restaurants, tipping is guided by customary percentages based on service quality:

- 15% – Average service.

- 18% – Good service.

- 20% or more – Excellent service or upscale dining experiences.

These percentages are applied to the bill to determine the gratuity amount, but it’s important to know whether the tip should be calculated before or after tax, as this can affect the total.

How to Calculate a Tip Manually vs. Using a Restaurant Gratuity Calculator

Manual Calculation:

- Determine the tip percentage based on service quality.

- Multiply the bill amount (pre-tax or post-tax, depending on preference) by the tip percentage.

- Round the result to the nearest dollar or convenient amount.

- If splitting the bill, divide the total tip by the number of diners.

Example:

- Bill amount: $85

- Tip percentage: 18%

- Tip: $85 × 0.18 = $15.30

Using a Restaurant Gratuity Calculator:

- Enter the bill amount, desired tip percentage, and any applicable taxes.

- Optionally, input the number of diners if splitting the bill.

- The calculator automatically provides the tip amount, total bill, and per-person share, eliminating manual errors.

Tips for Splitting Bills Among Multiple People

When dining in a group, splitting tips can be tricky:

- Divide the total tip evenly among diners.

- For uneven contributions (e.g., someone had a cheaper meal), calculate the tip based on each individual’s bill portion.

- A restaurant gratuity calculator can handle both scenarios, giving a clear per-person breakdown quickly.

Including Taxes in Tip Calculation: Pre-Tax vs Post-Tax

Customers often wonder whether to calculate tips on the pre-tax or post-tax amount:

- Pre-Tax Method: Multiply the tip percentage by the bill before adding sales tax. Many diners prefer this method, and some states recommend it.

- Post-Tax Method: Calculate the tip based on the total bill including sales tax. This method slightly increases the tip amount but may be simpler for quick calculations.

Using a restaurant gratuity calculator allows you to toggle between pre-tax and post-tax options automatically, ensuring accuracy and convenience for both single diners and groups.

US Tax Considerations for Tips

Tips are not just a reward for good service—they are also considered taxable income under US law. Both employees and employers need to understand the tax implications of gratuities to remain compliant with federal, state, and local regulations. Proper reporting ensures transparency, avoids penalties, and keeps payroll accurate.

IRS Guidelines for Reporting Tips as Income

The Internal Revenue Service (IRS) requires all tipped income to be reported as part of an employee’s taxable income, regardless of whether tips are received in cash, via credit card, or as part of a tip pool. Employees must:

- Report tips to their employer on a monthly basis using IRS Form 4070 or similar payroll forms.

- Include tips when filing annual federal income tax returns.

- Record both cash tips and credit card tips accurately, as both are subject to taxation.

Failure to report tips can result in underpayment of taxes, fines, or audits by the IRS. Accurate reporting is not optional—it’s a legal requirement.

Federal Income Tax, Social Security, and Medicare Implications

Tips are subject to standard federal income tax, as well as Social Security and Medicare contributions. Employers use reported tips to calculate payroll withholdings, which ensures that employees contribute correctly to these programs. Key points include:

- Cash tips must be added to wages for tax withholding purposes.

- Credit card tips are automatically reported through the employer and included in payroll calculations.

- Social Security and Medicare taxes are applied to the combined total of wages plus tips.

Understanding these implications is crucial for employees, as it affects take-home pay and retirement contributions.

State and Local Tax Variations

In addition to federal taxes, some states and municipalities impose their own tax rules on tips. For example:

- Certain states require separate reporting for tip income on state tax returns.

- Local jurisdictions may have unique payroll reporting requirements for tipped employees.

- Some states regulate tip pooling or mandatory service charges, which can affect how tips are distributed and taxed.

Employees and employers must be aware of local variations to ensure full compliance and avoid potential fines or payroll disputes.

Employer Obligations for Tip Reporting and Payroll

Employers have a responsibility to:

- Collect accurate tip reports from employees regularly.

- Include tip income in payroll calculations for federal, state, and local tax purposes.

- Ensure proper distribution of pooled tips or service charges in accordance with state laws and company policy.

- Maintain documentation for IRS compliance and audits.

Employers who fail to track tips properly may face penalties, and employees may end up with inaccurate tax records or underreported income.

Importance of Accurate Calculations for Both Employees and Businesses

Accurate tip and gratuity calculations are essential for financial transparency and compliance. For employees, it guarantees that taxable income is reported correctly and that they receive all the earnings they are entitled to. For employers, it ensures payroll accuracy, avoids legal complications, and promotes trust among staff.

Using a US tax and gratuity calculator or a restaurant gratuity calculator can simplify this process by automatically calculating tips, taxes, and total earnings. These tools reduce errors, save time, and help both employees and employers stay fully compliant with IRS and state regulations.

Digital Tip and Tax Calculators for Restaurants

Modern technology has made it easier than ever to calculate tips and taxes accurately. Digital calculators for gratuity and tax help both restaurant staff and customers manage payments quickly, ensuring fairness and compliance with federal and state rules.

Overview of Digital Tools for Tips and Taxes

These calculators allow users to input simple details such as:

- Total bill amount

- Tip percentage

- Applicable federal, state, and local taxes

- Number of diners splitting the bill (optional)

Once the inputs are entered, the calculator instantly provides:

- The tip amount

- The total bill, including taxes

- Per-person breakdowns for groups

- Optional calculations for service charges or pooled tips

Advantages of Using a Digital Calculator

Using a restaurant gratuity calculator or US tax and gratuity calculator offers several benefits:

- Speed: Calculates tips and taxes in seconds.

- Accuracy: Reduces human errors, especially for large bills or complex splits.

- Mobile-Friendly: Access anytime, anywhere via smartphone or tablet.

- Ease of Use: No math or tax expertise required; results are clear and easy to read.

Generic vs. Restaurant-Specific Calculators

- Generic calculators: Provide basic tip calculations and simple bill splits but may not account for taxes or tip pooling.

- Restaurant-specific calculators: Designed for the service industry with features like tip sharing among staff, pre-tax vs post-tax options, and detailed payroll support.

Choosing the Right Digital Tool

When selecting an online calculator:

- Ensure it supports tax calculations for federal and local requirements.

- Check for bill splitting and tip pooling options if needed.

- Look for a mobile-friendly interface for convenience at the table.

- Confirm it delivers clear, detailed results for total payments and tips.

A reliable restaurant gratuity calculator or digital tip and tax tool saves time, ensures accuracy, and promotes transparency for employees, customers, and restaurant managers alike.

Common Mistakes to Avoid When Calculating Tips

Accurate tip calculation is essential for fairness, compliance, and smooth operations in the restaurant industry. However, errors are common, and even small mistakes can lead to disputes, underpayment, or tax issues. Understanding the most frequent mistakes can help both employees and customers avoid problems.

Using Incorrect Tip Percentages

One of the most common mistakes is applying the wrong tip percentage. In the US, standard tipping ranges are typically 15% for average service, 18% for good service, and 20% or more for excellent service. Using a lower or higher percentage unintentionally can result in over- or under-tipping, which affects both employee income and customer satisfaction. Using a restaurant gratuity calculator ensures the correct percentage is applied consistently.

Forgetting to Account for Taxes

Many people calculate tips based only on the pre-tax or post-tax bill, without realizing the impact of taxes. This can lead to inconsistent tip amounts:

- Calculating based on pre-tax ensures the tip is proportional to the actual service value.

- Calculating based on post-tax slightly increases the tip but may be simpler for quick payments.

Failing to consider taxes, especially in areas with high sales tax rates, can cause underpayment or confusion.

Splitting Tips Incorrectly Among Staff

In restaurants where tips are pooled or shared among employees, incorrect splitting is a frequent error. Mistakes may include:

- Unequal distribution among staff based on hours or roles

- Forgetting to include all employees entitled to pooled tips

- Miscalculating shares for part-time or temporary staff

A digital restaurant gratuity calculator can simplify tip pooling and ensure fair distribution among all employees.

Misreporting Tips for Tax Purposes

Tips are considered taxable income by the IRS, and employees must report them accurately. Common mistakes include:

- Underreporting cash tips

- Forgetting to report credit card tips

- Failing to submit monthly tip reports to employers

Incorrect reporting can result in penalties, fines, or IRS audits. Keeping accurate records or using a tax and gratuity calculator with reporting features helps avoid these issues.

Overlooking Service Charges Included in the Bill

Some restaurants add automatic service charges for large parties or special events. These charges are not the same as tips but are often confused with them. Mistakes include:

- Calculating an additional tip on top of the service charge unnecessarily

- Failing to distribute service charges properly among staff

Understanding the difference between service charges and voluntary tips is crucial. Calculators often include options to account for service charges separately, ensuring accurate payments.

Tips for Customers and Employees

Tipping may seem simple, but understanding the proper approach benefits everyone—customers, employees, and employers alike. Using digital tools like a restaurant gratuity calculator can make the process faster, more accurate, and stress-free.

Customers: How to Tip Fairly and Calculate Efficiently

Customers can ensure they tip appropriately by:

- Following standard percentages (15% for average service, 18% for good service, 20% or more for excellent service).

- Deciding whether to calculate tips pre-tax or post-tax based on preference or local custom.

- Using a digital tip calculator to quickly determine the correct tip, especially for large bills or groups.

- Accounting for special circumstances, such as service charges, delivery fees, or large party surcharges.

By calculating tips accurately, customers show appreciation for service while avoiding overpayment or disputes.

Employees: How to Track Tips for Accurate Tax Reporting

For restaurant staff, tracking tips correctly is essential because all tips are taxable income:

- Record cash and credit card tips daily to maintain accurate logs.

- Submit tip reports to employers on time for payroll purposes.

- Use a restaurant gratuity calculator to double-check calculations and ensure all tips are accounted for.

Accurate tip tracking protects employees from IRS penalties, ensures fair wages, and simplifies year-end tax reporting.

Employers: Ensuring Fair Tip Distribution and IRS Compliance

Employers play a critical role in managing gratuities:

- Monitor tip pooling and distribution to ensure fairness among staff.

- Include reported tips in payroll calculations for federal, state, and local taxes.

- Maintain clear records to stay compliant with IRS regulations and avoid audits.

- Provide employees with transparent reporting tools or digital calculators to reduce errors and disputes.

Using a Restaurant Gratuity Calculator as a Practical Solution for Everyone

A restaurant gratuity calculator bridges the gap between customers, employees, and employers by:

- Offering fast, accurate tip calculations for bills of any size.

- Supporting fair distribution of pooled tips among staff.

- Providing per-person breakdowns for group dining.

- Simplifying tax reporting for employees and payroll for employers.

By leveraging these digital tools, restaurants can ensure a seamless, transparent, and compliant tipping process.

Advanced Features in Gratuity Calculators

Modern gratuity calculators go beyond simple percentage-based calculations. Advanced features make tipping and tax management easier, especially for restaurants and large groups.

Tip Rounding Options

Some calculators allow users to round tips up or down to the nearest dollar or convenient amount. This feature is especially helpful for customers who prefer simple, easy-to-pay totals, and it can speed up bill payment at busy tables.

Bill Splitting Among Diners

For group dining, calculators can divide the total bill, including tips and taxes, among multiple people. Advanced tools allow unequal splits, accounting for individual orders or contributions, so each person pays a fair share.

Tax-Inclusive or Tax-Exclusive Tip Calculations

Calculators often provide options to compute tips either pre-tax or post-tax:

- Pre-tax tips calculate gratuity based on the meal cost before sales tax.

- Post-tax tips include tax in the calculation, which may slightly increase the total tip amount.

Having both options allows users to follow personal preference or local customs accurately.

Multi-State Tax Support for US Users

Some calculators support federal, state, and local taxes, making them particularly useful for restaurants operating in multiple jurisdictions. Employees and employers can calculate accurate tip totals without worrying about tax differences between states or cities.

Mobile App vs. Online Web Tool Features

Modern gratuity calculators are available as:

- Mobile apps: Convenient for diners on the go, with quick access at the table or for delivery services.

- Web-based tools: Ideal for desktop use in restaurants, payroll offices, or personal computers.

Both options often include interactive features, clear displays, and the ability to save or share results, making tip and tax calculations faster, easier, and more accurate.

FAQs

Conclusion

Accurate calculation of tips and taxes is essential for a smooth and fair dining experience. For employees, proper tip tracking ensures they receive the compensation they’ve earned and remain compliant with IRS and state tax requirements. For employers, accurate calculations prevent payroll errors, promote transparency, and maintain compliance with federal and local regulations.

Using a US tax and gratuity calculator or a restaurant gratuity calculator brings convenience, speed, and accuracy to the process. These digital tools automatically calculate tips, split bills among diners, include taxes, and provide detailed breakdowns, eliminating the risk of errors that come with manual calculations.

Adopting these tools saves time, reduces confusion, and ensures fairness for everyone involved—from diners leaving a tip to staff receiving their earnings. Beyond convenience, these calculators help maintain tax compliance, making reporting easier for employees and payroll management simpler for employers.

By integrating a reliable gratuity calculator into your routine, whether as a customer, employee, or manager, you can confidently handle tips and taxes with precision, efficiency, and transparency.