Calculate Your UAE Gratuity in Seconds

Get clear, accurate calculations for your end-of-service pay in just a few clicks.

Gratuity Calculator UAE

Total Gratuity Payable To You

AED 0.00

The gratuity calculator UAE is a simple and reliable tool designed to help employees calculate their end-of-service gratuity in accordance with UAE Labour Law. Gratuity, also known as an end-of-service benefit, is a lump-sum payment that employers are legally required to pay eligible employees when their employment ends after completing a minimum period of service.

Under UAE Labour Law, most private-sector employees who have completed at least one year of continuous service are entitled to gratuity. The final amount depends on factors such as the employee’s last drawn basic salary, total years of service, and the reason for leaving the job. This benefit plays an important role in financial planning, especially for expatriates working in the UAE.

Using a UAE gratuity calculator removes the complexity of manual calculations and legal formulas. Instead of interpreting labour law rules yourself, you can instantly estimate your entitlement, ensuring accuracy and saving time. Whether you are planning a job change, resignation, or retirement, this tool provides clear insights into your expected payout.

The calculator is equally useful for employees working across different emirates, including those searching specifically for a gratuity calculator, as UAE gratuity rules are applied at the federal level. With a user-friendly interface and instant results, the gratuity calculator UAE helps employees make informed financial decisions with confidence.

What Is Gratuity Under UAE Labour Law?

Gratuity under UAE Labour Law refers to the end-of-service benefit paid by an employer to an employee when their employment contract comes to an end. It is a statutory right for eligible employees and is calculated based on the employee’s last drawn basic salary and total length of continuous service. Gratuity does not include allowances such as housing, transport, or overtime unless explicitly stated in the contract.

For expatriate employees, gratuity is especially important because it often serves as a major financial cushion after leaving a job in the UAE. Since most expatriates do not have access to long-term pension schemes within the country, gratuity acts as a form of savings or compensation for years of service. Many employees rely on this amount for relocation costs, future investments, or personal financial planning.

UAE Labour Law clearly governs how gratuity payments must be calculated and paid. The law outlines eligibility criteria, calculation formulas, and situations where gratuity may be reduced or forfeited, such as cases involving termination for serious misconduct. Employers are legally obligated to settle gratuity dues at the end of employment, ensuring transparency and fairness in the employer–employee relationship.

Previously, the UAE distinguished between limited and unlimited contracts, with different gratuity rules applying to each, particularly in cases of resignation. However, following labour law updates, this distinction has largely been unified under standard employment contracts. While older contracts may still reference limited or unlimited terms, gratuity is now generally calculated using consistent rules, making it easier for employees to understand their entitlements and estimate their end-of-service benefits accurately.

How the Gratuity Calculator UAE Works

The gratuity calculator For UAE is designed to simplify the process of calculating end-of-service benefits by following the latest UAE Labour Law guidelines. Instead of dealing with complex formulas and legal interpretations, employees can estimate their gratuity quickly and accurately by entering a few essential details. This makes the UAE gratuity calculator an ideal solution for employees, HR professionals, and employers who want clear and reliable results.

Inputs Required for Gratuity Calculation

To generate an accurate estimate, the calculator typically requires the following inputs:

- Last drawn basic salary:

This is the most important factor in gratuity calculation. Only the basic salary is considered under UAE Labour Law, excluding allowances such as housing, transport, or bonuses. - Years of service:

The total duration of continuous employment with the same employer, calculated in years (and sometimes months or days for precision). - Contract type:

Whether the employment ended due to resignation or termination, as this can affect eligibility and the final gratuity amount in certain cases.

How the Calculation Is Done Automatically

Once the required details are entered, the system automatically applies the official UAE gratuity formula. It calculates gratuity based on service length—typically half a month’s basic salary for each of the first five years and one full month’s salary for each additional year—while also applying any legal caps or conditions. This automated process eliminates errors that often occur with manual calculations.

Benefits of Using a Gratuity Calculator Online

Using a gratuity calculator offers several advantages over manual calculations. It provides instant results without requiring legal knowledge, ensures accuracy by following updated labour laws, and saves time for users. Additionally, a gratuity calculator is accessible from any device, making it convenient for employees to plan their finances anytime and anywhere with confidence.

UAE Gratuity Calculation Formula Explained

The UAE gratuity calculation follows a standard formula defined under UAE Labour Law, making it easier for employees to understand how their end-of-service benefit is calculated. The formula is based on the employee’s last drawn basic salary and total years of continuous service, with different rates applied before and after completing five years of employment.

Gratuity Formula for the First 5 Years

For the first five years of service, gratuity is calculated at the rate of 21 days’ basic salary for each completed year.

In simple terms, this means the employee earns the equivalent of half a month’s basic salary for every year worked during this period.

Example:

If an employee has worked for 3 years, gratuity will be calculated as 21 days of basic salary × 3 years.

Gratuity Formula After 5 Years

For each year of service beyond five years, the calculation rate increases to 30 days’ basic salary per year.

This is equal to one full month’s basic salary for every additional year worked after completing the initial five years.

Example:

If an employee has worked for 7 years, gratuity is calculated as:

- 21 days’ salary × 5 years

- 30 days’ salary × 2 years

The total of both amounts gives the final gratuity payable.

MOHRE Standard Rules for Gratuity Calculation

These formulas are based on the official guidelines issued by the UAE Ministry of Human Resources and Emiratisation (MOHRE). According to MOHRE rules, the total gratuity amount cannot exceed two years’ basic salary, regardless of the length of service. Employees can cross-check their estimates using official references such as the mohre gratuity calculator to ensure compliance with current labour law standards.

By following these clear and standardized rules, employees can confidently estimate their gratuity and avoid confusion or miscalculations.

MOHRE Gratuity Calculator vs Online Gratuity Calculator

The mohre gratuity calculator is an official tool provided by the UAE Ministry of Human Resources and Emiratisation to help employees and employers estimate end-of-service gratuity based on UAE Labour Law. It follows government-approved formulas and reflects statutory rules, making it a reliable reference point for understanding legal entitlements.

What Is the MOHRE Gratuity Calculator?

The mohre gratuity calculator is designed primarily for compliance and regulatory clarity. It calculates gratuity using standard inputs such as basic salary, length of service, and employment status. Because it is maintained by MOHRE, it reflects the official interpretation of labour law and is often used by HR departments to verify calculations before final settlement.

Limitations of Official Gratuity Tools

While accurate, official calculators may have certain limitations. They often provide limited flexibility, minimal explanations, and a less user-friendly interface. Some tools may not clearly break down the calculation steps, which can make it difficult for employees to fully understand how their gratuity amount was derived or how changes in salary or service duration affect the final figure.

How an Advanced Gratuity Calculator UAE Adds Value

An advanced gratuity calculator UAE is built for convenience, speed, and clarity. It offers instant results, simple input fields, and clear breakdowns of each calculation step. Many online calculators also include explanatory notes, mobile-friendly design, and real-time updates, allowing users to experiment with different scenarios and plan their finances more effectively.

When to Rely on MOHRE Data for Compliance

For legal compliance, dispute resolution, or official HR processing, MOHRE guidelines and data should always be considered the final authority. Employees and employers can use online calculators for planning and estimation, then cross-verify results with MOHRE standards to ensure accuracy and legal alignment. This combined approach offers both ease of use and regulatory confidence.

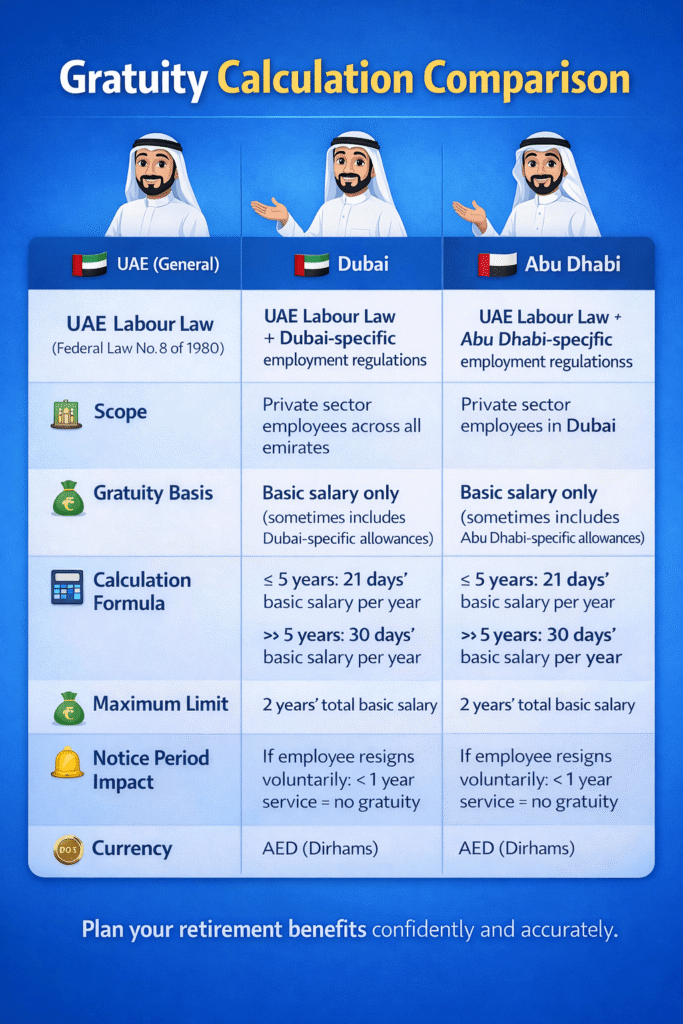

Gratuity Calculator for Different Emirates

While the UAE follows federal labour law for gratuity calculations, employees in different emirates may sometimes have specific considerations. Fortunately, a single UAE gratuity calculator can accurately estimate benefits for all regions, including Dubai and Abu Dhabi.

Gratuity Calculator Dubai

The gratuity calculator Dubai is tailored for private-sector employees working in Dubai, helping them calculate their end-of-service benefits in accordance with UAE Labour Law. It takes into account the last drawn basic salary, years of service, and contract type to provide an accurate estimate.

Practical Considerations:

- Employees working in Dubai mainland and free zones may have slightly different HR procedures or payroll practices, but the federal gratuity formula remains the same.

- Using a gratuity calculator Dubai ensures that employees understand their entitlements clearly before leaving a job, especially if they plan to move between free zones or transfer employment.

Gratuity Calculator Abu Dhabi

Similarly, the gratuity calculator Abu Dhabi serves employees in Abu Dhabi, providing instant and accurate calculations based on the same federal labour law.

Key Points:

- Applicable for all private-sector employees in Abu Dhabi, including those in special economic zones.

- Uses the same calculation principles as Dubai: 21 days’ basic salary for the first five years and 30 days’ salary for each subsequent year.

Even though employees work in different emirates, the gratuity calculator UAE works universally, offering consistent results whether you are in Dubai, Abu Dhabi, or other emirates. By using one reliable calculator, employees can plan their finances with confidence and avoid confusion caused by varying payroll practices.

Note: For clarity, all estimates can be cross-checked with MOHRE standards, ensuring both accuracy and compliance with UAE law.

Who Is Eligible for Gratuity in UAE?

Understanding gratuity eligibility is crucial for employees planning their financial future in the UAE. UAE Labour Law clearly defines who qualifies for end-of-service benefits, ensuring fairness for both employers and employees.

Minimum Service Period

To be eligible for gratuity, an employee must have completed at least one year of continuous service with the same employer. Employees with less than one year of service are generally not entitled to gratuity, except in certain termination scenarios where partial benefits may apply.

Resignation vs Termination

The amount of gratuity an employee receives can vary depending on how the employment ended:

- Resignation: Employees who resign before completing five years of service may be eligible for partial gratuity. If resignation occurs after five years, they receive full gratuity.

- Termination: Employees terminated by the employer (without cause) are generally entitled to full gratuity, even if their service period is shorter, in accordance with federal labour law.

Full vs Partial Gratuity Eligibility

- Full gratuity: Granted to employees who complete five or more years of service or are terminated by the employer without cause.

- Partial gratuity: Granted to employees who resign before completing five years of service, calculated proportionally based on the number of years worked.

Exclusions

Employees may lose gratuity entitlement in certain situations, such as:

- Termination for gross misconduct or violations of company policy

- Resignation during a probation period

- Cases where the employee voluntarily breaches the employment contract

By understanding these eligibility rules, employees can better plan their career transitions and ensure they receive the gratuity they are entitled to under UAE Labour Law.

Benefits of Using a Gratuity Calculator Online

Using a gratuity calculator online offers significant advantages for employees, HR teams, and employers alike, making the process of estimating end-of-service benefits faster, simpler, and more reliable.

Instant and Accurate Results

A major benefit of a Online gratuity calculator is the ability to get instant calculations. By simply entering a few details like basic salary, years of service, and contract type, employees can immediately see an accurate estimate of their gratuity. This eliminates the need for manual calculations, which can be time-consuming and prone to errors, especially when dealing with multiple years of service or complex employment terms.

Mobile-Friendly Access

Most online gratuity calculators are mobile-friendly, allowing employees to access them from smartphones or tablets anytime, anywhere. Whether you are at home, in the office, or traveling, you can quickly check your gratuity estimate without needing specialized software or paperwork. This convenience is particularly helpful for expatriates who frequently move between jobs or emirates.

No Legal or Formula Knowledge Required

The gratuity calculator online is designed for simplicity. Users do not need any knowledge of UAE Labour Law or the official gratuity formulas to use it effectively. The calculator automatically applies the correct legal rules, including calculations for partial service periods or differences between resignation and termination, ensuring accurate results with minimal effort.

Useful for Employees, HR Teams, and Employers

The calculator is not just for employees. HR teams and employers can also benefit by using a free online gratuity calculator to quickly verify settlements, prepare accurate payroll reports, and maintain compliance with MOHRE regulations. By providing transparency and clarity, the calculator helps prevent disputes and builds trust between employers and employees.

In summary, a gratuity calculator is a reliable, user-friendly, and legally compliant tool that makes understanding and planning end-of-service benefits simple for everyone in the UAE workforce.

Common Gratuity Calculation Mistakes to Avoid

Calculating gratuity in the UAE may seem straightforward, but small errors can lead to incorrect estimates or disputes with employers. Being aware of these common mistakes ensures your end-of-service benefit calculation is accurate and compliant with UAE Labour Law.

Using Total Salary Instead of Basic Salary

A frequent mistake is including the total salary—such as housing, transport, or bonuses—instead of the basic salary. According to UAE Labour Law, gratuity is always calculated based on the basic salary. Including additional allowances can significantly overstate the expected benefit and lead to confusion during settlement.

Ignoring Contract Type

The type of employment contract—whether limited or unlimited—can affect eligibility, particularly for employees resigning before completing five years of service. Ignoring this detail can result in miscalculating partial gratuity. Using a digital gratuity calculator with the correct contract type ensures more precise results.

Not Counting Exact Service Duration

Miscounting the exact years, months, or days of service is another common error. Gratuity calculations are sensitive to the precise length of employment, and even a few months can make a difference, especially when approaching milestones like five years of service. Always verify your employment start and end dates.

Assuming Allowances Are Included

Many employees assume benefits like housing, transport, or performance bonuses are part of gratuity. In reality, gratuity is strictly based on the basic salary, unless your contract specifically states otherwise. Misunderstanding this can create unrealistic expectations or disputes at the end of employment.

By avoiding these mistakes, employees can confidently use an online gratuity calculator or other digital gratuity tools to get a clear and accurate estimate of their end-of-service benefits, making financial planning easier and more transparent.

Frequently Asked Questions (FAQs)

Conclusion

Understanding and calculating your end-of-service gratuity is an essential part of financial planning for anyone working in the UAE. Gratuity represents not just a legal entitlement, but also a financial reward for years of service. Whether you are planning a career move, resignation, or retirement, knowing your expected gratuity helps you make informed decisions and secure your financial future.

Using a reliable gratuity calculator in UAE allows employees to estimate their benefits quickly and accurately. By entering basic details such as salary, service duration, and contract type, you can get an immediate understanding of what you are entitled to, without worrying about complex legal formulas or manual calculations.

A good gratuity calculator ensures accuracy, transparency, and ease of use, giving employees confidence that their calculations reflect current UAE Labour Law. It also helps HR teams and employers streamline settlements, reducing misunderstandings and ensuring compliance with MOHRE standards.

In summary, whether you are an employee planning your next step or an HR professional verifying end-of-service payments, a trusted gratuity calculator For UAE is an invaluable tool. It empowers you with clarity, saves time, and guarantees that your gratuity is calculated correctly—allowing you to focus on your career while ensuring your legal entitlements are fully protected.